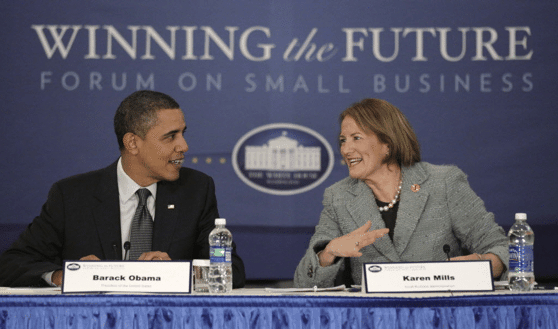

Karen Mills, former Administrator of the Small Business Administration and current Senior Fellow at Harvard University, co-authored a study on credit markets and SMEs back in 2014. She recently presented at LendIt Europe on the state of Marketplace / Peer to peer lending.

While at the SBA, Mills discovered there was a credit gap as banks refused to give small loans to businesses leaving an important part of our economy out in the cold. Mills did what she could while at the SBA and boosted loans to small business but it wasn’t enough.

In the US, small firms create 2/3 of the net jobs. In the UK, 65% of net job creation comes from small business. These small companies were the hardest hit during the financial crisis. Ironically they were also part of the collateral fallout when banks had to tighten their balance sheets pulling credit from SMEs thus exacerbating the financial duress further.

In the US, small firms create 2/3 of the net jobs. In the UK, 65% of net job creation comes from small business. These small companies were the hardest hit during the financial crisis. Ironically they were also part of the collateral fallout when banks had to tighten their balance sheets pulling credit from SMEs thus exacerbating the financial duress further.

In the US policy makers were quick to react but new rules made small banks struggle even more. A period of consolidation began – one that continues today- as costly compliance make it difficult to operate. Of course these same small banks used to provide about 40% of SME loans. In the UK things are a bit different as the country is dominated by 5 large banks and policy makers have embraced peer to peer lending.

The market supply / demand imbalance increased opportunity for Fintech entrepreneurs to step in and fill the capital void. P2P / Marketplace lending platforms have quickly become a much needed alternative to old banks.

Mills’ presentation ends with questions regarding regulation and the appropriate amount to safeguard borrowers and lenders while allowing the new industry to grow.

It is an excellent view of online lending and it is embedded below.

[scribd id=288915509 key=key-1ZDFmHDna44A69MbJ6VA mode=scroll]