John Biggs, East Coast Editor of TechCrunch, says he is leaving the “best job I ever hard” to launch a Fintech startup. While Biggs is still listed as an Editor at TechCrunch and the stories continue to roll in, but the migration to entrepreneur is clearly under way.

John Biggs, East Coast Editor of TechCrunch, says he is leaving the “best job I ever hard” to launch a Fintech startup. While Biggs is still listed as an Editor at TechCrunch and the stories continue to roll in, but the migration to entrepreneur is clearly under way.

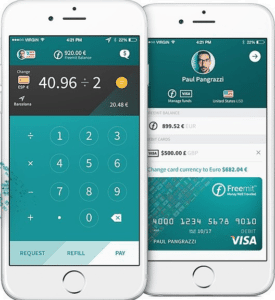

Biggs is now founder and CEO of Freemit, a new platform that hopes to disrupt the business of money transfers. In a recent missive mailed out to followers, Biggs stated;

“Our banks are robbing us. If you send $100 anywhere in the world, it will cost you and the receiver between $5-$17, depending on how you send it. If it needs to get there right away, you will pay even more to do it. If you can wait 3 to 4 days then you will pay less. Either way the bank wins. If it is an instant transfer the bank can charge high fees. If it takes 3-4 days, the bank gets to take advantage of the ‘float.’ You may not know it, but banks can use your money to make money for even just a few days. And trust me, they do. And this doesn’t make sense anymore. Because the world has changed. There is this thing called the Internet, which changed everything. Email killed the inefficient postal service. iTunes killed the record companies. Amazon is killing brick and mortar stores. The list goes on. Every industry in the world has been transformed. Disrupted. Except banking. And except money transfer. But that is going to change. It has to change. Why has it taken so long?”

In a Freemit blog post, management explains the one industry that has been “strangely resistant” to the disruption engendered by the internet – is banking and money transfer. Today a traditional money transfer lumbers along, passing between multiple banks, each taking its cut of the largely automatic process. But in the real world, international money transfers no longer need the bank. Freemit states that technology that powers cryptocurrencies, blockchain, is the future;

In a Freemit blog post, management explains the one industry that has been “strangely resistant” to the disruption engendered by the internet – is banking and money transfer. Today a traditional money transfer lumbers along, passing between multiple banks, each taking its cut of the largely automatic process. But in the real world, international money transfers no longer need the bank. Freemit states that technology that powers cryptocurrencies, blockchain, is the future;

“Bitcoin’s blockchain technology, and the open ledger that all can see, effectively cuts out the need for central banking oversight of transfers. This makes instant money transfer something that can and should happen in the near future. Instead of complicated transfers between banks, central banks, and receiving banks, Bitcoin creates an easy, entirely digital, transparent, and trustworthy system for money transfer. When it comes to foreign exchange transactions Bitcoin is set to shatter the paradigm. Banks charge 3-5% on foreign exchange transfers because they have a monopoly on this system. But the advent of Bitcoin essentially cuts out the middleman on any foreign exchange. Instead of going through banks, Bitcoin exchanges can now function as an instant, automated, and transparent exchange system. With Bitcoin the possibility now exists for the creation of a universal, instant, and cost-free system of international money exchange.”

The Freemit service is pretty straightforward. Someone may transfer any amount of money instantly to a registered Freemit user and a holder of a Freemit credit card. Reviewing the comparison chart published by Freemit, a similar $100 transfer by Chase would cost $40 in fees and take one to two days. That is incredibly inefficient and costly to the user. Using PayPal is a bit better as the fees drop to “just” $6, but the transfer drags on for up to 5 days. According to the World Bank, the global average cost of sending $200 held steady at 8% of the value of the transaction, as of Q4 of 2014. That means you (the sender) lose $16 on that $200 transaction – not a small amount. The same report by the World Bank states the global remittance industry in 2014 was a mere $583 billion – so the opportunity is significant.

The Freemit service is pretty straightforward. Someone may transfer any amount of money instantly to a registered Freemit user and a holder of a Freemit credit card. Reviewing the comparison chart published by Freemit, a similar $100 transfer by Chase would cost $40 in fees and take one to two days. That is incredibly inefficient and costly to the user. Using PayPal is a bit better as the fees drop to “just” $6, but the transfer drags on for up to 5 days. According to the World Bank, the global average cost of sending $200 held steady at 8% of the value of the transaction, as of Q4 of 2014. That means you (the sender) lose $16 on that $200 transaction – not a small amount. The same report by the World Bank states the global remittance industry in 2014 was a mere $583 billion – so the opportunity is significant.

Freemit transfers and deposits money minus any fees. The company apparently will monetize the service via credit card service fees – something you would most likely pay anyway when you spend the digital cash.

Biggs has put together a team of professionals to help launch his venture. He has joined with COO Richard Svinkin, a UX executive with several large companies on his resume and Paul Goudas, who was formerly head of high-frequency trading at a Wall Street bank. While the site is live, the service, as of yet, has not launched. To incentivize sign-ups, Freemit is giving away $10 “free” if you join the waitlist.