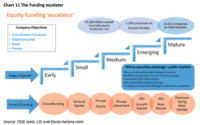

European Union Looks to Make it Easier for Firms to List Shares, Especially SMEs

As part of the ongoing objective of a Capital Markets Union, the European Union has announced new proposals aimed at making it easier for firms to list securities across the EU. According to a statement by the EU: Today’s proposed measures will: Make our clearing… Read More

Read more in: Global, Politics, Legal & Regulation | Tagged capital markets union, EU, european union, mairead mcGuinness, valdis dombrovskis