Goldman Sachs Continues Retail Fintech Retreat as Marcus Invest to be Sold to Betterment

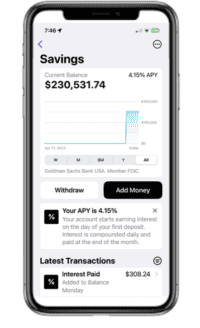

Goldman Sachs (NYSE:GS) , the most respected investment bank in the world, is continuing its retreat from retail Fintech services as it revealed this week that Marcus Invest, its Fintech wealth management platform, would be shuttered and services picked up by Betterment, a registered investment adviser…. Read More

Read more in: Featured Headlines, Fintech, Opinion | Tagged betterment, goldman sachs, marcus, marcus invest, perspective