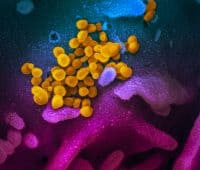

Robocash Claims P2P Lending Market Is an Attractive Investment Diversification Option, but Sector has Struggled due to COVID

Robo.cash, a peer to peer (P2P) lending marketplace, recently discussed which investments may be “advantageous” during the COVID-19 pandemic. The P2P lender noted in a blog post that COVID, which began spreading in Europe in March and April 2020, led to “unrest” among P2P investors…. Read More

Read more in: Global, Investment Platforms and Marketplaces | Tagged coronavirus, covid-19, europe, investments, lending, p2p lender, p2p lending, peer to peer, robo.cash, robocash, stocks