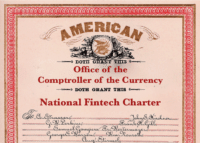

Regulatory Notice: FINRA Asks for Comments on Capital Formation Including Crowdfunding & More

The Financial Industry Regulatory Authority (FINRA) has filed a regulatory notice and a request for comments regarding capital formation. The review includes aspects of the JOBS Act and crowdfunding. FINRA said the request for comments was part of its FINRA360 initiative, a comprehensive review of… Read More

Read more in: Politics, Legal & Regulation, General News | Tagged finra, jobs act, regulation cf, regulations, robert cook