Aprenita is a recent entry into the online lending sector. While the largest platforms focus on consumer or SME lending, Aprenita has established a laser-focused niche.

Founded by Mark Loranger and Sergei Kovalenko, the entrepreneurial pair has “identified a critical funding gap where old systems and models are failing to address the capital needs of modern technology ventures”. More specifically; financing App development.

The entire App ecosystem really did not exist until the iPhone was launched and Steve Jobs was convinced to allow 3rd party applications (Apps) on its iconic device. Since Apple revolutionized the smartphone sector back in 2007, the Apple App store has generated over $40 billion for App developers. The App store’s success is responsible for creating and supporting approximately 1.9 million jobs in the US alone. According to Apple, over 1.4 million of those jobs are directly  attributable to App creators; the software engineers and entrepreneurs that have participated in the booming software sector. This has been augmented by the launch of the iPad, Apple TV and Apple Watch each with its own specific Apps. Of course there is the Android App ecosystem too that measures downloads and revenue in the billions as well.

attributable to App creators; the software engineers and entrepreneurs that have participated in the booming software sector. This has been augmented by the launch of the iPad, Apple TV and Apple Watch each with its own specific Apps. Of course there is the Android App ecosystem too that measures downloads and revenue in the billions as well.

All of this adds up to a very large industry that is relatively new and largely associated with smaller firms. And what do many smaller companies need for growth? Access to capital of course.

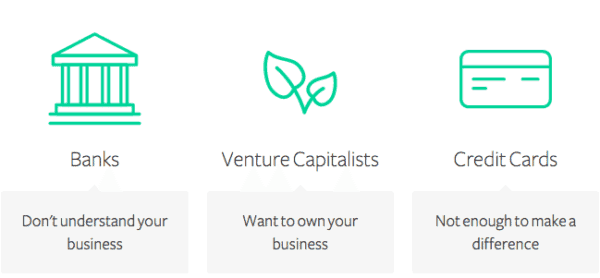

Aprenita believes there is a disconnect between traditional finance (think banks) and the demands of App developers that need money to build, launch and market their Apps. Both Loranger and Kovalenko have backgrounds in tech / software development so they are more than comfortable with the App dev ecosystem. Online lending is quickly fragmenting the banking process by providing a streamlined, user-friendly process that can deliver results measured in days – not works (or perhaps months). Aprenita sees opportunity in doing the same by providing financing to a fast growth sector and specializing in the service it provides.

Crowdfund Insider recently spoke with Aprenita founder Mark Loranger to learn more about their innovative financial firm. Our discussion is below.

Crowdfund Insider: Please explain your vision of “Capital as a Service” (CaaS)?

Crowdfund Insider: Please explain your vision of “Capital as a Service” (CaaS)?

Mark Loranger: We’re a technology company, so we built a platform that has the familiarity of other software services that our customers are using. Our signup and application process is totally seamless, and we offer single-click integrations with all of the sources of information required for analysis. Ultimately, we believe that the capital we provide should be deployed on-demand, with varying options based on our customer’s stage, qualification and needs.

Crowdfund Insider: Why Apps? What compelled you to launch a platform to help finance App development?

Mark Loranger: A couple reasons – we have personal experience in lending money to app companies and this is a valuable, yet underserved market. We believe that the best startups are launched by founders who have experienced a unique pain point (or inefficiency) in an industry or market. Once we found this, we started thinking of scalable ways to solve this problem with technology. We didn’t want to simply fund more app companies, we wanted to rethink what it means to be credit-worthy as a small business, and build some really powerful and innovative technology along the way.

Crowdfund Insider: How much traction have you received to date? How do you source companies?

Crowdfund Insider: How much traction have you received to date? How do you source companies?

Mark Loranger: We’ve gotten great traction since we launched our beta in September 2015. We’re now working with app companies across many different categories, including health & fitness, lifestyle, gaming and even B2B apps. In addition, our customers are at varying stages of development, with portfolios of a single app or more than 50. A sample of those companies have provided testimonials which you can see on our homepage. We’re sourcing companies through a variety of means – including direct outreach, word of mouth, advertising and even working with developer meetup groups.

Crowdfund Insider: How are you financing the loans?

Mark Loranger: We are financing the loans off our balance sheet, which means it’s the company’s own money. The money has been raised with our own personal capital as well friends and family in the tech industry who believe in what we’re building.

Crowdfund Insider: What about competitors in the App Dev funding space? Couldn’t App creators use marketplace lending platforms?

Crowdfund Insider: What about competitors in the App Dev funding space? Couldn’t App creators use marketplace lending platforms?

Mark Loranger: There will always be competitors that emerge in when there’s a great market opportunity, but that is a good thing. App creators might be able to use marketplace lending platforms, but we’re confident that our exclusive focus on app businesses will enable us to deliver a dramatically better and more affordable experience for our customers.

Crowdfund Insider: What is unique about your data / analytics approach in determining credit risk?

Mark Loranger: We’re not requiring personal guarantees or relying on FICO scores to determine a company’s creditworthiness. That’s extremely unique in small business lending, and we believe is a major differentiator. We simply require our customers to link the accounts that are relevant to determining the health of their business – their app store, ad network and analytics accounts. The ease of this entire process is pretty singular in comparison to any other type of financing relationship.

Crowdfund Insider: Have you considered leveraging your model for other, similar verticals? If so, which ones?

Mark Loranger: Right now, we’re exclusively focused on companies that are developing & publishing mobile apps. There’s a real pain point for getting access to capital in this market, and we think the opportunity is massive. However, it’s hard to say what might happen 5-10 years from now. As experienced founders and investors, we’ve seen many success stories from companies whose market focus or business model evolves over time, so we won’t rule anything out.

Crowdfund Insider: What are you estimating for platform growth for 2016?

Mark Loranger: We hope to onboard as many clients as possible who are qualified and ready for our service. Demand is high, so we’re just trying to keep up with that right now.