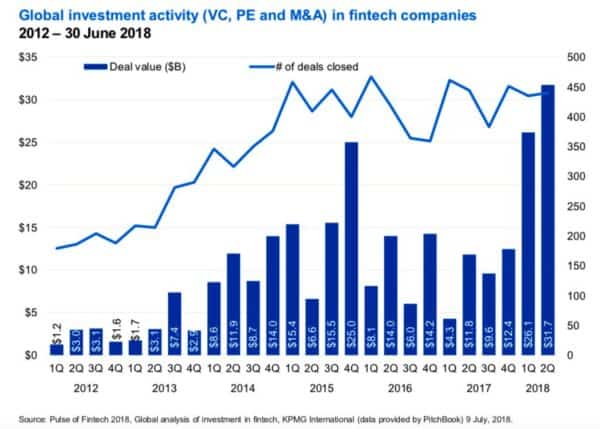

KPMG has published their Pulse of Fintech report highlighting global Fintech activity for the first half of 2018. According to KPMG, global investment in Fintech is going gangbusters as “Fintech market activity worldwide gained momentum during the first half of the year as the geographic diversity and reach of Fintech investment continued to expand.”

[clickToTweet tweet=”KPMG: global investment in #Fintech is going gangbusters as ‘Fintech market activity worldwide gained momentum during the first half of the year as the geographic diversity and reach of Fintech investment continued to expand.'” quote=”KPMG: global investment in #Fintech is going gangbusters as ‘Fintech market activity worldwide gained momentum during the first half of the year as the geographic diversity and reach of Fintech investment continued to expand.'”]

Two massive Fintech deals drove some of this activity. Ant Financial raised $14 billion this year and WorldPay was acquired by Vantiv for $12.9 billion. But these two huge deals were backed up by a robust sector of activity.

Globally, 857 deals raised $57.9 billion during the first six months. This amount already exceeds last year’s annual total – something that has been echoed in other Fintech research reports. Regtech played an interesting role as $1.37 billion was raised in this subcategory topping all of 2017.

The Americas accounted for the bulk of the number of deals registering 504 with the US leading the way. KPMG says that $14.8 billion was invested reaching new heights.

In Europe, $26 billion in Fintech investment was completed with the UK leading with $16 billion of that amount. Acquisitions and buyouts helped to power the category but the median size seed/angel round also rose to $1.5 million in 2018 from $1.2 million year prior.

Asia totaled $16.8 billion across 162 deals with Ant Financial obviously hoovering up much of this number. China and India dominated this region with India hitting a new high of 31 Fintech VC deals.

KPMG expects the global Fintech market to remain robust for the rest of the year. While the sector may be “maturing” there is still great opportunity as expansions in Regtech, Insurtech, Blockchain and more continue to boost investor interest.

The top ten deals (VC, PE, M&A) for the first 6 months of 2018 include:

- Ant Financial – $14 billion – China

- WorldPay – $12.9 billion – UK

- Nets – $5.5 billion – Denmark

- Blackhawk Network Holdings – $3.5 billion – US

- iZettle – $2.2 billion – Sweden

- IRIS Software Group – $1.8 billion – UK

- PowerPlan – $1.1 billion – US

- Cayan – $1.05 billion – US

- OpenLink Financial – $1 billion – US

- Nordax Group – $788 million – Sweden

Other points of note include:

- Investments in Insurtech and Regtech are expected to grow in the next 6 months

- Blockchain remains vibrant – particularly in the US. ICOs continue to drive interest helped by Block.one (EOS) raising $4 billion. US Blockchain investment in the first half exceeded the total of 2017.

- Changes in regulation will drive further Fintech investment. IE GDPR / Open Banking. Other countries will follow down the Open Banking path

- Brazil is the Fintech leader in LatAm with Nubank’s $150 million raise “dwarfing” other deals

- Canada: Toronto and Montreal have “evolved into strong Fintech hubs.”

- Traditional banks continue to invest in digital banking initiatives. Digital challenger bank Marcus is an example as the Goldman Sachs founded operation expanded into the UK.

There is plenty more in the report. You can read it all below.