Earlier this week, the World Economic Forum (WEF) published an interesting report covering the usage and investigation of Central Bank Digital Currency (CBDC). It has been widely reported that many central banks have been kicking the tires of CBDC with some making proclamations regarding the possibility of a central bank issuing a digital currency. Most banks have not yet reached any definitive conclusion regarding the potential for CBDC usage.

The WEF notes that 40 central banks around the world are reviewing CBDCs in some capacity. Frequently, these projects are not widely reported.

Additionally, author Ashley Lanquist has collected a compendium of all CBDC research papers emanating from central banks.

The WEF report highlights the Bank of Canada, the Bank of England, and the Monetary Authority of Singapore (MAS), as producing the most research to date. The UK was the first in 2014 with the paper entitled “The economics of digital currencies” and “Innovations in payments technologies and the emergence of digital currencies”. The Bank of France has successfully deployed a DLT-based application.

While the jury is still out regarding efficacy and viability, the WEF report predicts that emerging country central banks may be the biggest beneficiaries of CBDCs.

“[These countries] may experience the greatest gains from DLT implementations where existing financial processes and technology systems are not yet highly efficient or deeply rooted. They may also achieve greater financial inclusion from implementing CBDC or other blockchain-based applications. For central banks around the world, DLT applications such as CBDC can increase efficiency and reduce frictions in cross-border payments, on both the consumer (retail) and the interbank (wholesale) levels.”

The WEF paper is embedded below as is the current list of research papers.

The WEF shares ten possible use cases for a CBDC. They include:

|

1 |

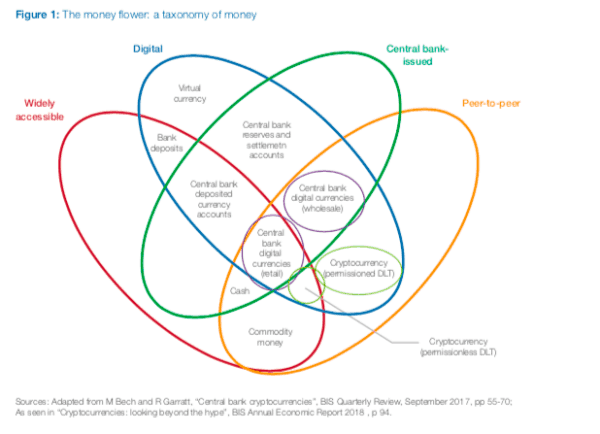

Retail central bank digital currency (CBDC) – Central bank-issued digital currency that is operated and settled in a peer-to-peer and decentralized manner (no intermediary), widely available for consumer use. Serves as a complement or substitute for physical cash and alternative to traditional bank deposits. |

|

2 |

Wholesale central bank digital currency (CBDC) – Central bank-issued digital currency that is operated and settled in a peer-to-peer and decentralized manner (no intermediary), available only for commercial banks and clearing houses for use in the wholesale interbank market. |

|

3 |

Interbank securities settlement – A focused application of blockchain-based digital currency, including CBDC, enabling the rapid interbank clearing and settlement of securities for cash. Can achieve “delivery versus payment” interbank systems where two parties trading an asset, such as a security for cash, can conduct the payment for and delivery of the asset simultaneously. |

|

4 |

Payment system resiliency and contingency – The use of DLT in a primary or back-up domestic interbank payment and settlement system to provide safety and continuity from threats, including technical or network failure, natural disaster, cybercrime, and other threats. Often, this use case is coupled with others as part of the set of benefits that a DLT implementation could potentially offer. |

|

5 |

Bond issuance and lifecycle management – The use of DLT in the bond auction, issuance, or other lifecycle processes to reduce costs and increase efficiency. May be applied to bonds issued and managed by sovereign states, international organizations or government agencies. Central banks or government regulators could be “observer nodes” to monitor activity where relevant. |

|

6 |

Know-your-customer and anti-money-laundering – Digital KYC/AML processes that leverage DLT to track and share relevant customer payment and identity information to streamline processes. May connect to a digital national identity platform or plug into pre-existing e-KYC or AML systems. Could potentially interact with CBDC as part of payments and financial activity tracking. |

|

7 |

Information exchange and data sharing – The use of distributed or decentralized databases to create alternative systems for information and data sharing between or within related government or private sector institutions. |

|

8 |

Trade finance – The employment of a decentralized database and functionality to enable faster, more efficient and more inclusive trade financing. Improves on today’s trade finance processes which are often paper-based, labour-intensive and time-intensive. Customer information and transaction histories are shared between participants in the decentralized database while maintaining privacy and confidentiality where needed. |

|

9 |

Cash money supply chain – The use of DLT for issuing, tracking and managing the delivery and movement of cash from production facilities to the central bank and commercial bank branches; could include the ordering, depositing or movement of funds, and could simplify regulatory reporting. |

|

10 |

Customer SEPA Creditor Identifier (SCI) provisioning – Blockchain-based decentralized sharing repository for SEPA credit identifiers managed by the central bank and commercial banks in the SEPA debiting scheme. Faster, streamlined and decentralized system for identity provisioning and sharing. Can replace preexisting manual and centralized processes that are time and resource-intensive. Seen in Bank of France’s Project MADRE implementation. |