Yesterday, Crowdfund Insider covered the transition by Al Rayan Bank to an app-based banking platform.

Yesterday, Crowdfund Insider covered the transition by Al Rayan Bank to an app-based banking platform.

Today, the Bank has provided additional information on this transition.

According to company representatives:

“Customers need to register for the Mobile Banking app by 4th March to ensure uninterrupted digital banking, although they can still register to use the app any time after 4th March. No customer accounts or banking arrangements will be affected by the switch over to Mobile Banking whenever they choose to do so.

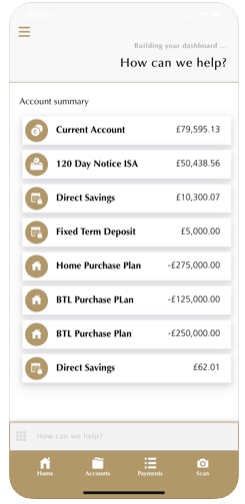

“The Mobile Banking app – which has been used by many thousands of Al Rayan Bank’s customers since its launch last year – is more secure, quicker and easier to use. The app ensures all customers have a secure service 24/7 with second factor authentication to improve security. This has been designed and implemented based on demand for more convenient and mobile-led banking services from our customers. Existing Online Banking customers who do not have a compatible smartphone will be able to continue to access their accounts online through a free hard token, which will enable them to continue to access their accounts via a desktop computer.”

The Bank also provided the following additional information:

In July and August last year, the Bank contacted all Online Banking customers to notify them of the changes and has this week confirmed detail of the date of the change and instructions on where and how to download the Mobile Banking app.

-

- ‘Active users’ i.e. those who regularly transact through online banking’, received further communication prior to this week explaining that they would need to download the Mobile Banking app.

- This applies to all online banking personal customers using online savings and current account products

- All other services, including telephone banking and in-branch services are unaffected by the change

- Customers can download the Mobile Banking app by visiting alrayanbank.co.uk/mobile where they will be able to download the app via the appropriate app store, or via text link that will be sent to them directly

- There are supporting videos and FAQs to help customers at alrayanbank.co.uk/mobile

- Existing Online Banking customers who do not have a compatible smartphone will be able to continue to access their accounts online through a free hard token, which will enable them to continue to access their accounts via a desktop computer. To find out if they are eligible for a hard-token device, customers should call Al Rayan Bank. If they are eligible, we will explain the process to them over the phone and in written communication.

- Only existing online customers will be eligible for a hard-token device. All new customers who want to open online accounts from March 4th will need to have a compatible smart phone to be eligible. However, we have alternative channels for new and existing customers to manage their accounts including telephone banking, in branch and post.