CFPB Touts Lending Halt at LendUp Loans, a Fintech Backed by Google Ventures, QED Investors and More

The Consumer Financial Protection Bureau (CFPB) has halted the lending at LendUp Loans, according to a statement by the regulator. Currently, its website states that the company has made a business decision to cease lending and is no longer servicing loans. According to the CFPB,… Read More

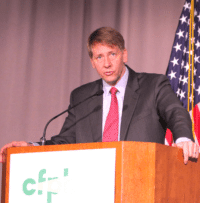

Read more in: Fintech, Politics, Legal & Regulation | Tagged cfpb, online lending, payday lender, rohit chopra