Colu, a blockchain-powered platform for creating digitized, localized currencies, launched its second currency in the UK – the Local Pound, East London. Founded in 2014, Colu’s digital wallet application supports buying local, offering an easy and convenient way to pay instantly from a smartphone while empowering local businesses. Complementing the British Pound Sterling, the Local Pound, East London provides locals with a digitized, localized currency to facilitate a stronger, more sustainable local economy and community.

“Colu is about building communities from the wallet up, offering a way for locals to infuse their money with meaning by supporting local businesses — a win-win for everyone,” stated Colu CEO and Co-Founder Amos Meiri. “Small businesses are the backbone of the UK economy, and an investment in local businesses is really an investment in the residents of East London. By introducing the Local Pound, East London, we plan to change the way people think about money in the heart of the UK.”

“Colu is about building communities from the wallet up, offering a way for locals to infuse their money with meaning by supporting local businesses — a win-win for everyone,” stated Colu CEO and Co-Founder Amos Meiri. “Small businesses are the backbone of the UK economy, and an investment in local businesses is really an investment in the residents of East London. By introducing the Local Pound, East London, we plan to change the way people think about money in the heart of the UK.”

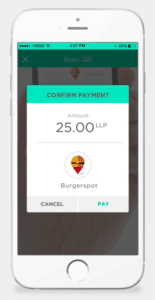

Digital payments and localized currencies are both growing trends in the UK, as fintech enables more seamless and efficient financial transactions and communities seek to ensure the success of their local economies and businesses. Colu merges these two financial trends to create a new way of thinking about money that encourages sustainable and equitable economic growth while supporting local merchants. The company offers P2P and peer-to-merchant app-based payment platforms facilitating digital financial transactions at local businesses, creating a closed-loop economy that bolsters both the economic well-being and social fabric of the community.

Built on open-source, blockchain infrastructure, Colu creates the digital equivalent of cash with the flexibility to handle millions of transactions in real-time, all of which are verified and authenticated using advanced security protocols. Colu’s open-source technology protocol allows for direct exchanges of digital cash, revolutionizing the way money is transferred, creating a P2P economy.

Built on open-source, blockchain infrastructure, Colu creates the digital equivalent of cash with the flexibility to handle millions of transactions in real-time, all of which are verified and authenticated using advanced security protocols. Colu’s open-source technology protocol allows for direct exchanges of digital cash, revolutionizing the way money is transferred, creating a P2P economy.

Colu provides participating local businesses with a digital toolbox – vital business tools to help them better compete with large retailers, including a merchant dashboard that replaces the need for point-of-sale systems. Since the launch of the Local Pound, Liverpool in late 2016, over 16,000 residents and merchants have begun using the Colu app daily, making purchases at businesses such as bars, restaurants, fitness clubs and beauty shops.

“I’m often asked why we chose to launch currencies in places like East London and Liverpool,” added Meiri. “It’s because these areas have a unique combination of intense community pride, trendy new businesses and a bustling tech scene, making them the perfect places to build a new digital, local economy.”

“I’m often asked why we chose to launch currencies in places like East London and Liverpool,” added Meiri. “It’s because these areas have a unique combination of intense community pride, trendy new businesses and a bustling tech scene, making them the perfect places to build a new digital, local economy.”

Backed by funding from venture firms Aleph and Spark Capital, Colu has already created several digital, local currencies outside the UK, including Israel, and has provided Barbados with the technology to create its own digital currency. Colu is nearing 50,000 users worldwide, spending almost $1 million at small businesses through the app.