The dust is still settling and the G.O.P has some serious introspection to endure, but now the real work must commence once again. The Democrats must stumble back into the position of power in the White House which they have duly earned.

The dust is still settling and the G.O.P has some serious introspection to endure, but now the real work must commence once again. The Democrats must stumble back into the position of power in the White House which they have duly earned.

The reality is that in the United States the list is long as the needs are pressing. First up happens to be that cliff thing everyone keeps talking about, something which should have been (and I think could have been) rectified some time ago… but that is not how our enduring political system works so let’s talk about more important things:

Wall Street is now realizing it has to deal with an Administration which has not been very laudatory over the past months, and financial firms are starting to assess their standing. Most firms expect an increase in both capital gains tax rates as well as increased taxes on dividends. The final form? Unknown.

What these expectations do is lower the value of equity investments. When your risk-related returns are expected to decline those investments lose some of their value. With the legalization of equity-based crowdfunding around the bend this may put a damper on crowd funded investments. Exceptions, or “subsidies,” may potentially arise to encourage this new form of raising capital but at this point it remains an unknown. In contrast to the Obama platform, Romney had been quite vocal on lowering taxes on investments but where did that get him?

So the above is not a positive for crowdfunding hopefuls. The Obama administration, however, has been forthright (if not always forthcoming) on vocalizing support for small business.

As we pointed out in our prior missive, Small and Medium Enterprises (SMEs) are the engine of job growth for our country. The SBA under Obama has been vocal on this point. Obama’s own platform states “entrepreneurs and small businesses are engines of economic growth, and their investments and innovation have been at the forefront of our economic recovery.” He has also been an advocate on lowering corporate income taxes in general in light of our competitive situation with other more tax advantageous countries.

Now everyone realizes the JOBS Act was a significant achievement for an administration which has been at times challenged indisplaying their successes. It was a product of increasingly rare bipartisanship and carries something for everyone. The administration would be hard pressed not to be vocal in its ongoing support even during this period of regulatory navel-gazing.

John Boehner, Speaker of the House and currently the highest elected Republican official, needs to prove that reaching across the aisle doesn’t mean an act of spite. Therefore, it appears this area of economic hope falls under a realm where both sides can concur. Growth in small business is good. Crowdfunding will accelerate this growth.

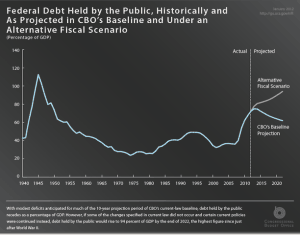

Now, if the two sides can just get by this whole Fiscal Cliff issue…