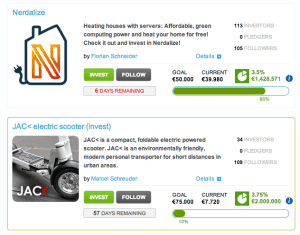

Symbid is one of the first investment crowdfunding platforms to launch live in Europe. The Rotterdam based company was co- founded in the Netherlands by Korstiaan Zandvliet in 2011. The idea was born of a concept while Korstiaan was attending business school at ERASMUS. The stark reality was that many of his classmates had great business ideas and good business plans but no access to capital. Korstiaan, currently Symbid Managing Director, set out to change all that. Now Symbid is well established in the Dutch market and looking to expand.

Symbid is one of the first investment crowdfunding platforms to launch live in Europe. The Rotterdam based company was co- founded in the Netherlands by Korstiaan Zandvliet in 2011. The idea was born of a concept while Korstiaan was attending business school at ERASMUS. The stark reality was that many of his classmates had great business ideas and good business plans but no access to capital. Korstiaan, currently Symbid Managing Director, set out to change all that. Now Symbid is well established in the Dutch market and looking to expand.

I originally spoke to Korstiaan in the spring earlier this year. I thought it would be interesting to catch up with him and get an update on their progress. Symbid has recently gone through a fundraising round themselves generating sufficient capital to pursue their vision. Crowdfunding in Europe is different in each country. Although there has been a movement to create a seemless market for investment crowdfunding to operate Europe wide – quick facilitation will probably not occur. With that in mind I reached out to Korstiaan for insight and feedback on the future of crowdfunding and Europe and an update on Symbid.

I originally spoke to Korstiaan in the spring earlier this year. I thought it would be interesting to catch up with him and get an update on their progress. Symbid has recently gone through a fundraising round themselves generating sufficient capital to pursue their vision. Crowdfunding in Europe is different in each country. Although there has been a movement to create a seemless market for investment crowdfunding to operate Europe wide – quick facilitation will probably not occur. With that in mind I reached out to Korstiaan for insight and feedback on the future of crowdfunding and Europe and an update on Symbid.

Dominique: I understand much progress is being made at Symbid and you are preparing to expand in multiple countries. Can you give me an update?

Korstiaan: Yes, we are actively preparing market entries for some European countries and we have several projects with a global scope. In short we are ramping up for an international expansion while simultaneously closing an investment round for Symbid. We recently closed a seed round for our valuation service Equidam, allowing us to further develop next generation equity crowdfunding tools. We are also working with several Universities in the United States and Europe to create a more clearly defined mechanism for matching investors with the right proposals.

Dominique: That’s very exciting for you and for Symbid. Any other recent developments that you  would like to share?

would like to share?

Korstiaan: At Symbid we are focused at becoming more receptive towards the wishes of investors. We have started requesting detailed historical, as well as future financial information (from companies crowdfunding). Entrepreneurs can now choose to either get an Equidam report or let their accountant load up their information (P&L, Balance Sheet etc.).

Dominique: I recently was reading the presentation given by Ronald Kleverlaan, Co-Founder of the European Crowdfunding Network (ECN) in which he had stressed the challenges regarding the unique regulatory environment presently in existence in each European country.

Korstiaan: Ronald is exactly right. There are 26 different legislations. The sovereign members of the EU have final call on how to implement their own rules. Our strategy today is to follow the local process by providing necessary permits and licenses. We will have local teams for local branches using a global system.

Dominique: What are your thoughts on crowdfunding growth in Europe?

Dominique: What are your thoughts on crowdfunding growth in Europe?

Korstiaan: It is unlikely that Europe will ever have a unified crowdfunding legislation. Therefore we are pursuing a country by country roll out.

Dominique: Any other challenges?

Korstiaan: On-boarding entrepreneurs remains the same, really the only difference is complying with local legislation. Europe will continue to be a fragmented market. 30% of our investors originate from another country in the EU other than the Netherlands. I do think the EU will review the Jobs Act and will enforce similar – but less strict – rules eventually.

Dominique: What are your thoughts on the potential for fraud?

Dominique: What are your thoughts on the potential for fraud?

Korstiaan: We have been operating a cross country platform for over 3 years. We do check for money laundering and other sorts of white-collar fraud. Our due diligence is very thorough and there is also social due diligence as part of the process. For example an accountant must accept them as a client to have a full fledged campaign page. And you must be capable of selling your shares to your family and friends. Once you can sell your plan to them then you are invited to present to a wider audience. Entrepreneurs are also encouraged to meet face-to-face in the Symbid offices. If there is something fishy about a proposal – it will come out during this process.

DLR.