Mosaic, a solar project crowdfunding platform, has had a pretty amazing year. Having only been launched to the world in early 2013 the site has captured the attention of the crowdfunding community and green energy enthusiasts everywhere.

Mosaic, a solar project crowdfunding platform, has had a pretty amazing year. Having only been launched to the world in early 2013 the site has captured the attention of the crowdfunding community and green energy enthusiasts everywhere.

Founded in 2010 by three entrepreneurs, Bill Parish, Dan Rosen and Steve Richmond, the leadership team has created a unique and innovative platform which applies business principles to finance clean energy and deliver a decent return on investment. Their mission is to make the connection with investors, both individuals and institutions, to exceptionally high quality solar projects, and fundamentally change the way energy is financed. And face it: unless something drastic changes, we don’t expect to run out of sunshine any time soon which is a significant advantage over some of solar’s main competitors.

Mosaic has first mover advantage in the United States, offering investments in California and New York. There are other energy based crowdfunding platforms around the world. In fact Windcentrale in the Netherlands has laid claim to the fastest / most amount ever in a crowdfunding campaign, having raised €1.3 Million in just 13 hours – which is a pretty astounding feat. Mosaic crowdfunded their first project in January 2013 closing in less than 24 hours raising over $313,000 which certainly proved demand for their product.

Mosaic has first mover advantage in the United States, offering investments in California and New York. There are other energy based crowdfunding platforms around the world. In fact Windcentrale in the Netherlands has laid claim to the fastest / most amount ever in a crowdfunding campaign, having raised €1.3 Million in just 13 hours – which is a pretty astounding feat. Mosaic crowdfunded their first project in January 2013 closing in less than 24 hours raising over $313,000 which certainly proved demand for their product.

In the ensuing months the platform has raised over $5 Million in a space they largely have to themselves. Mosaic has benefited from a unique set of laws in California which allowed the portal to offer investments not only to accredited investors but to the non-accredited types as well. True crowdfunding. Mosaic is not offering equity yet but is allowing investors to invest directly in solar projects via debt financing for these deals.

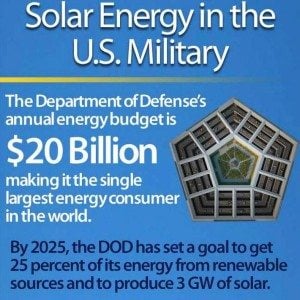

Recently the innovative platform partnered with True Green Capital and CIT to offer a really unique deal. Solar crowdfunding for the military at Fort Dix. The Department of Defense has an approximate annual energy budget of $20 Billion and has set a goal of reducing dependency on non-renewable energy. Strategically DOD wants 25% of their energy from renewable sources and solar is at the top of the list.

Recently the innovative platform partnered with True Green Capital and CIT to offer a really unique deal. Solar crowdfunding for the military at Fort Dix. The Department of Defense has an approximate annual energy budget of $20 Billion and has set a goal of reducing dependency on non-renewable energy. Strategically DOD wants 25% of their energy from renewable sources and solar is at the top of the list.

The Fort Dix project is their largest installation to date (12.3 MW) but is not the largest transaction (by dollar amount) on their platform. That title goes to the Wildwoods Convention Center in New Jersey where the combined retail and accredited investors financed a 487 kW installation for $1.3 Million.

First off the Fort Dix offering is still open for retail investors. Retail may finance up to $250,000. The accredited portion has already closed where 25 investors funded $361,000. While 75% of their projects have closed in the first week, all projects have a final close date of 90 days after the offer is opened.

The size of the Fort Dix project and the partnering with CIT plus True Green Capital was pretty fascinating so we reached out to Mosaic spokesperson Katie Ullman for more insight into Mosaic and details on recent projects;

The size of the Fort Dix project and the partnering with CIT plus True Green Capital was pretty fascinating so we reached out to Mosaic spokesperson Katie Ullman for more insight into Mosaic and details on recent projects;

“Since January 2013, Mosaic has had over $5 million invested into solar projects on its platform, with over 2,300 investors in 44 states. Mosaic has made 100% on-time payments to investors and had zero defaults to-date.”

The Mosaic team only chooses high quality opportunities, so project selection is very selective. In describing the process Katie shared that,

“The team receives nearly 20 requests for financing every week. Of those leads, Mosaic turns down 99% of them, choosing to work only with top solar developers and projects.”

“Mosaic has strong underwriting requirements, and we follow rigorous procedures to make sure they are met”, Katie continued. “Our underwriting process is very similar to the process used by banks in that we work with third party attorneys, engineering specialists, and insurance professionals to review and evaluate each project. Furthermore, we are working with partners to standardize the way solar risk is evaluated.”

“Our investment committee looks at all the risks associated with each solar project and chooses only what we consider to be relatively low-risk and high-quality projects to finance. In general, the primary risks are: credit risk, technology risk, operational risk, and weather risk– and our job is to mitigate those risks. For example, to mitigate against the risk of a solar project being damaged by a storm, we require that there be sufficient property damage insurance to cover the cost of repairing the project.”

Returns are solid on Mosaic projects. The Fort Dix project has an expected yield of Libor +2.25% to 2.5%. Most projects listed on the platform today range in yield from 4.4% to 6.38% which is pretty respectable in the current low interest rate environment.

With a top solar finance team and a combined experience of 50 years and $1 Billion transaction volume they know they are paving the path to the future. Now if we can just get the rest of the country to join in.

With a top solar finance team and a combined experience of 50 years and $1 Billion transaction volume they know they are paving the path to the future. Now if we can just get the rest of the country to join in.