By December 18, 2014 the Securities and Exchange Commission (SEC) had proposed or adopted regulations mandated by Titles II, III and IV of the Jumpstart Our Business Startups Act of 2012 (JOBS Act). Those regulations impact crowdfunding in many ways.

By December 18, 2014 the Securities and Exchange Commission (SEC) had proposed or adopted regulations mandated by Titles II, III and IV of the Jumpstart Our Business Startups Act of 2012 (JOBS Act). Those regulations impact crowdfunding in many ways.

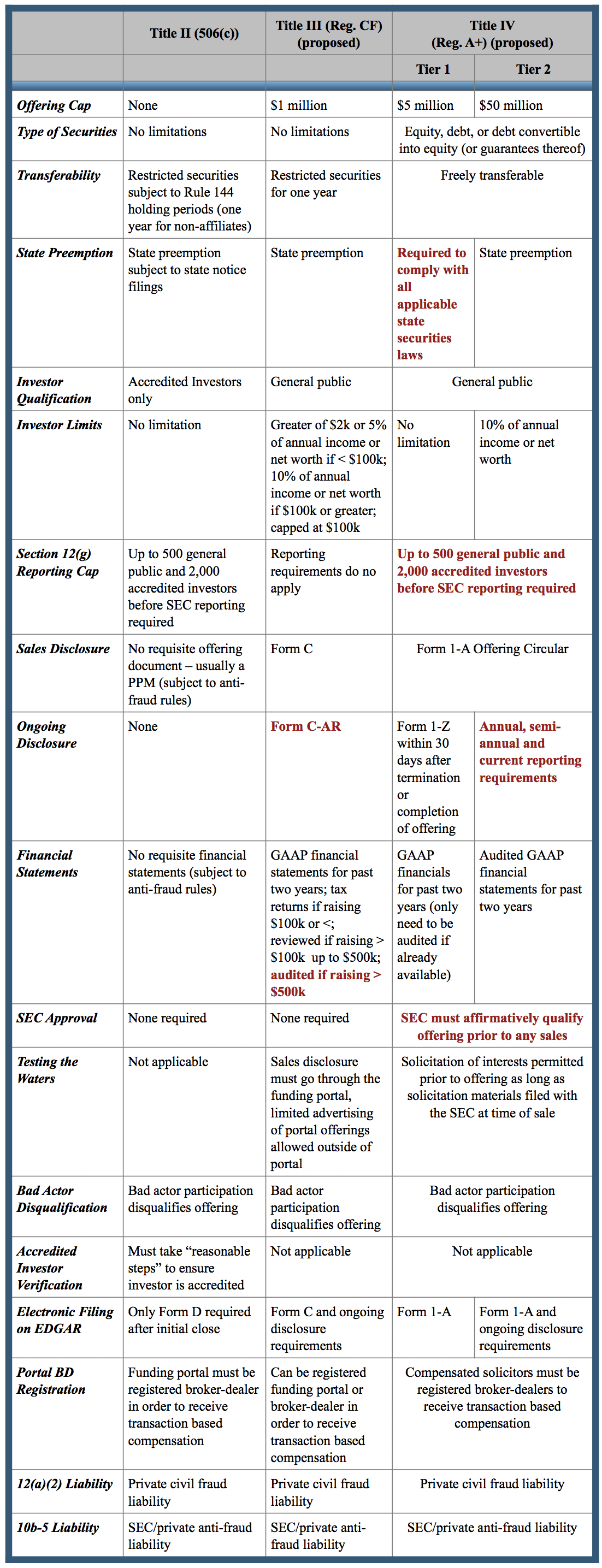

Issuers will now have a menu of options when deciding what type of offering they want to conduct and what exemption from securities registration they want to use.

Title II allows for crowdfunding targeting accredited investors only; Title III allows for crowdfunding targeting the general public but with a $1 million annual fundraising cap; and Title IV allows for crowdfunding targeting the general public but subject to several restrictions including SEC approval of the offering.

Of course there are benefits and burdens to each type of offering and fortunately the SEC has opened a comment period where interested parties can provide feedback and suggestions regarding the proposed rules.

Below is a matrix depicting key provisions of SEC regulations promulgated or proposed. Potential showstoppers in the proposed regulations which may make them cost-inefficient or inoperable in a crowdfunding setting are in red.

1 Comments relating to Title III Regulation CF are due by February 3, 2014 and comments relating to Title IV Regulation A+ are due by 60 days from the time the proposed rules are published in the Federal Register, so likely around the end of February.

____________________________

Georgia P. Quinn is a senior associate in the New York office of Seyfarth Shaw LLP. A member of the firm’s Mergers & Acquisitions and Securities practice groups, Ms. Quinn represents corporations and investment banks in a wide range of capital markets transactions, including registered offerings and private placements of debt, equity, and trust preferred securities. All views and comments above are strictly her own views and do not reflect the opinion or position of Seyfarth Shaw.

Georgia P. Quinn is a senior associate in the New York office of Seyfarth Shaw LLP. A member of the firm’s Mergers & Acquisitions and Securities practice groups, Ms. Quinn represents corporations and investment banks in a wide range of capital markets transactions, including registered offerings and private placements of debt, equity, and trust preferred securities. All views and comments above are strictly her own views and do not reflect the opinion or position of Seyfarth Shaw.