The UK Peer to Peer Finance Association or P2PFA is a participant in the European expert group reviewing the environment for crowdfunding and peer to peer lending in the EU. Recently the group met and the P2PFA made a presentation delivered by Sam Ridler, Executive Director of the group.

The UK Peer to Peer Finance Association or P2PFA is a participant in the European expert group reviewing the environment for crowdfunding and peer to peer lending in the EU. Recently the group met and the P2PFA made a presentation delivered by Sam Ridler, Executive Director of the group.

P2P lending started in the UK and then migrated across the Atlantic to the US. The growth has been dramatic in both countries but the market is considerably smaller in the UK than in the US where companies such as Lending Club, Prosper, Funding Circle are leading the charge. The P2PFA is a representative group that has advocated on behalf of the relatively new sector and has helped to set standards and best practices to assure industry growth.

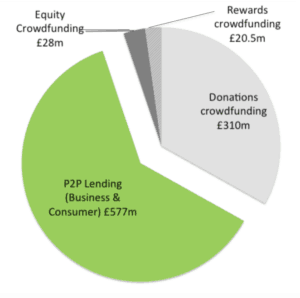

While equity crowdfunding is growing rapidly, it is dwarfed by P2P. Christine Farnish, Chair of the P2PFA recently stated;

“Peer-to-Peer consumer lending is set to double by the end of 2014 too. Given the government has already set out plans to include peer-to-peer lending as part of the ISA regime, the impact could be even greater next year.”

The document below shows why. High returns, lower risk and investors generate income quickly. Investing in equity crowdfunding opportunities is largely for the patient among us. The P2PFa reports a less than 1.5% default rate for member firms. That is incredible. Young firms that raise early stage capital are pretty risky. That being said the investors who believed in Facebook back in the day are pretty happy now.

Some additional bullets from the P2PFA:

- The P2P sector is disrup:ng the tradi:onal Oligopolies in retail investment, consumer and businesses lending

- P2P lending largest form of alternate finance and provide vital access to finance for SME

- Sustainable P2P plaVorms perform thorough due diligence on borrowers to ensure they offer low risk returns to investors

- P2P Lending and Equity crowdfunding are very different asset classes with different risk profiles for investors therefore an effec:ve code of conduct cannot be the same for both.

[scribd id=247054899 key=key-N4ZabqiKfsqH1eUqjEqC mode=scroll]