A new survey from the Peer to Peer Finance Association (P2PFA) indicates that consumers “overwhelmingly” believe that peer-to-peer lending should be separated from traditional Cash or Stocks & Shares ISAs. According to the P2PFA, the group polled over 4500 p2p investors regarding their preferences. This information comes at a time when the UK will soon decide how P2P assets will “sit within the ISA wrapper”.

The data also revealed that the majority of consumers (57 per cent) disagree that the creation of a lending ISA will add further complexity to the ISA regime.

The survey results include:

- 95 per cent welcome the UK Government’s decision to include peer-to-peer lending within the ISA wrapper

- 74 per cent say they like the idea of keeping their peer-to-peer lending in a separate lending ISA;

- 81 per cent agree that peer-to-peer lending has different characteristics to investments in a Stocks and Shares ISA

- 81 per cent agree that a lending ISA will introduce more choice across the investments market; and

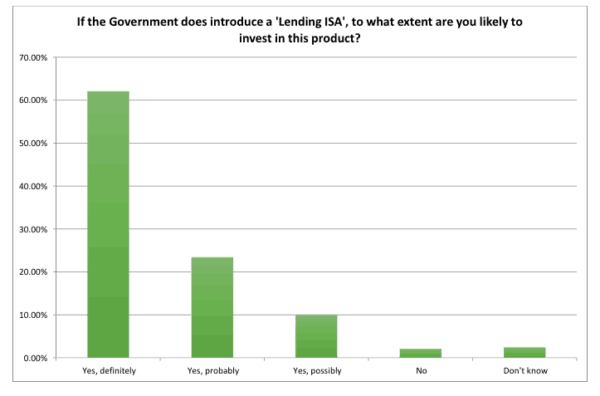

- If the Government introduces a lending ISA, 62 per cent will definitely invest in one.

Christine Farnish, Chair of the P2PFA, said of the survey results;

Christine Farnish, Chair of the P2PFA, said of the survey results;

“The survey’s results give a clear message; consumers want to see greater choice across the ISA market and the creation of a Lending ISA is a positive and necessary step. Peer-to-peer lenders and consumers fully back the decisions that have already been made by the Government, but it is quite clear that they do not want to see peer-to-peer lending shoehorned into either the cash or the stocks and shares category of ISA because it is different in kind”.

The survey was conducted in February 2015. The questions were distributed via an online survey to P2PFA member customers. The P2PFA’s current membership includes: Funding Circle, Landbay, Lendingworks, LendInvest, Madiston Lendloaninvest, MarketInvoice, RateSetter, ThinCats and Zopa.