CrowdPlus.Asia is the first, of the approved platforms, to launch in Malaysia – and across multiple Asian markets. CrowdPlus.asia will focus on the ASEAN market, having established a presence in Malaysia, Thailand and Vietnam, as well as mainland China and Hong Kong where there is a number of foreign investors present.

The CrowdPlus.asia platform is backed by Netrove Ventures Group, a regional tech-based VC firm, and Propellar Corporation Ltd, an equity crowdfunding operator based in Hong Kong. The Hong Kong company’s subsidiary Propellar Crowd+ is one of the six licensed ECF operators approved by the Securities Commission Malaysia (SC) in June. The others are Alix Global, Ata Plus, Crowdonomic, Eureeca and pitchIN.

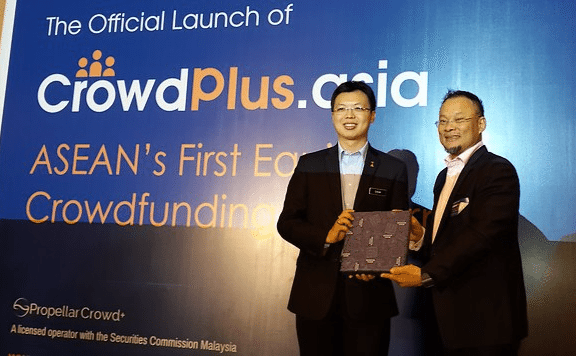

Malaysian Deputy Finance Minister Datuk Chua Tee Yong, who officially launched CrowdPlus.asia, stated that traditional crowdfunding is projected to raise US$30 billion globally this year, with the crowdfunding market forecasted to grow to US$90 billion by 2025.

Malaysian Deputy Finance Minister Datuk Chua Tee Yong, who officially launched CrowdPlus.asia, stated that traditional crowdfunding is projected to raise US$30 billion globally this year, with the crowdfunding market forecasted to grow to US$90 billion by 2025.

“There is also a healthy appetite for alternative market-based channels of financing which traditional financial avenues cannot satisfactorily address. The launch of CrowdPlus.asia will encourage ASEAN companies to set up their operations in Malaysia and raise funding through their platform,” Chua said.

Crowdplus.Asia described itself as using proven methodologies of venture capital (VC) investment for startups and SMEs to raise funds from the public, who in turn will take equity in the company and be a part of their growth.

“Equity crowdfunding is a disruptive financing platform,” said Teh Kim Seng, Chairman of CrowdPlus.asia. As the founder of Netrove Ventures Group, Teh observed that there are a lot of good companies and entrepreneurs but not enough funds to go around. “Venture capitalists are limited to what they can do for the overall industry. There is a huge gap between VC and conventional methods of financing. ECF can bridge that gap and change the landscape of the financing ecosystem.”

“They can handhold these companies and guide them on their entrepreneurial journey. We believe that the QMIs will help the startups and SMEs achieve greater value and grow faster,” Teh said, adding that CrowdPlus.asia currently has 30 QMIs.

“We look at the details, such as the company’s incorporation, shareholders and directors’ information, as well as a commercial assessment. Investors will have to make an online submission pertaining to the Anti-Money Laundering and Anti-Terrorism Financing Act.”

According to Chua, all of the platforms should be up and running by Q1 2016. “The equity crowdfunding segment is still very new and we may approve more ECF platforms in future depending on the market reception.”

According to Chua, all of the platforms should be up and running by Q1 2016. “The equity crowdfunding segment is still very new and we may approve more ECF platforms in future depending on the market reception.”

Malaysia was the first ASEAN country to embrace investment crowdfunding and enact a regulatory framework to facilitate the new form of finance. SC Malaysia has been recognized as a more innovative and forward thinking securities regulatory agency in Asia and has paved the way for other countries to follow.