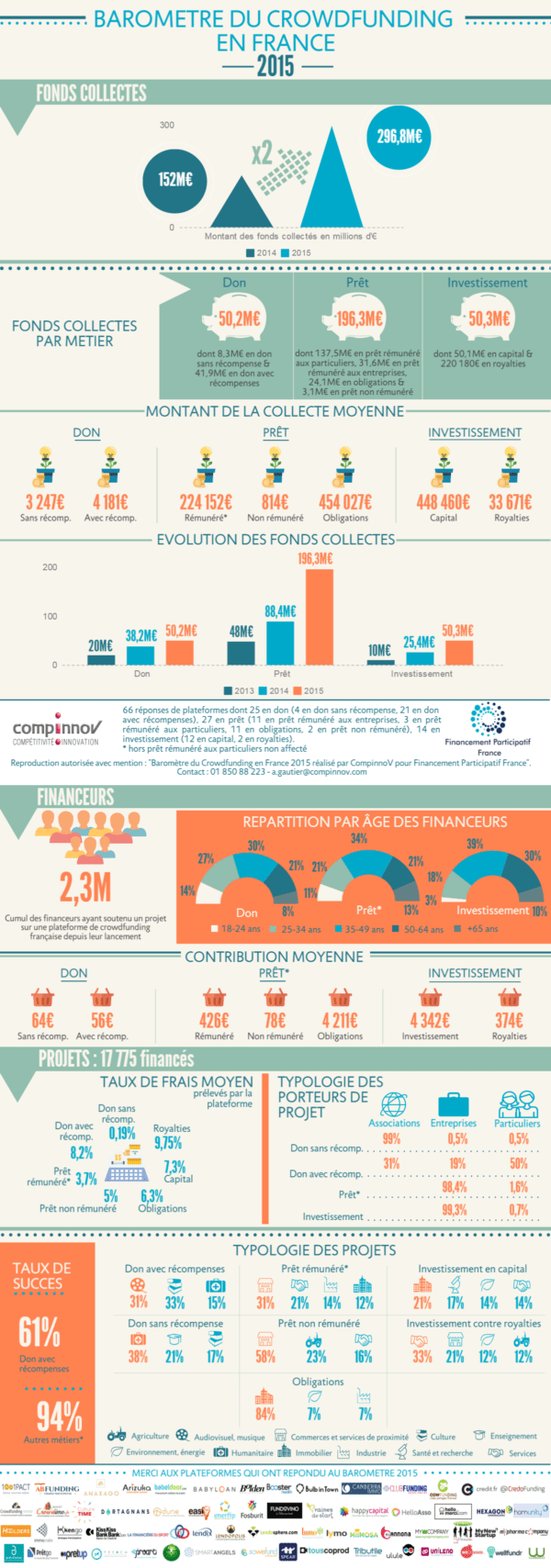

The Financement Participatif France (the French Crowdfunding Association) has published some data on activity in their country and in comparing 2014 to 2015, the industry nearly doubled. The slowest area of growth was in donations / rewards. The lending or debt sector experienced the most dramatic growth. In 2013, loan-based came in at €48 million. This number jumped to €88.4 million in 2014 and then more than doubled to just uncer €200 million for 2015.

The Financement Participatif France (the French Crowdfunding Association) has published some data on activity in their country and in comparing 2014 to 2015, the industry nearly doubled. The slowest area of growth was in donations / rewards. The lending or debt sector experienced the most dramatic growth. In 2013, loan-based came in at €48 million. This number jumped to €88.4 million in 2014 and then more than doubled to just uncer €200 million for 2015.

According to FPF funds collected jumped from €152 million in 2014 to €296.8 million for 2015. Breaking down those numbers further:

- Rewards / Donation – €50.2 million

- Loan based /P2P – €196.3 million

- Equity / Royalties – €50.3 million

- The most active age for all categories is 35-49 years old

- The average investment for an equity offer was €4,342

- Hottest sector for equity crowdfunding is real estate

FPF compiled their data from 66 different platform. Since the first platforms launched, back in 2008, about 2.3 million individuals have supported a project / business on a platform.

France enacted updated regulations for the new form of finance in October 2014. While not perfect, the rules have been sufficient to help foster a healthy ecosystem as all forms of finance migrate to the internet.