“Equity crowdfunding is becoming a more viable, accessible and attractive option for non-institutional investors in sectors that affect everyday life. Global connectivity, has meant that startups have greater entrée to investors from diverse geographies outside the traditional tech hubs, effectively strengthening the democratization process and diversifying the investor mix.”

Fresh from the most successful OurCrowd Global Investor Summit 2017, Israeli serial entrepreneur and OurCrowd founder and CEO, Jon Medved has become one of the most vocal and engaging advocates in the global investment crowdfunding sector. OurCrowd vets and selects opportunities, invests its own capital, and brings companies to its accredited membership of global investors.

In the last month alone, Medved made the prominent funding marketplace even stronger, partnering with German energy company innogy and the Shanghai Commercial & Savings Bank, proving that multinational crowdfunding is more than just a possibility. In less than five years, Medved and his OurCrowd team have not only amassed nearly 17,000 accredited investors from over 110 countries, celebrated 13 exits, 2 IPOs and 11 acquisitions, raised over $400M into 110 companies and funds, and vetted 5,500 companies, OurCrowd continues to lead the global equity crowdfunding sector for accredited investors.

In the last month alone, Medved made the prominent funding marketplace even stronger, partnering with German energy company innogy and the Shanghai Commercial & Savings Bank, proving that multinational crowdfunding is more than just a possibility. In less than five years, Medved and his OurCrowd team have not only amassed nearly 17,000 accredited investors from over 110 countries, celebrated 13 exits, 2 IPOs and 11 acquisitions, raised over $400M into 110 companies and funds, and vetted 5,500 companies, OurCrowd continues to lead the global equity crowdfunding sector for accredited investors.

Medved and I recently caught up via email to discuss equity crowdfunding, including the Summit, OurCrowd’s global success, investment trends and deal flow. Our interview follows:

Erin: I understand the OurCrowd summit was a solid success. How was 2017 different from years prior?

Jon Medved: This year was bigger and better than any of our previous years, with twice as many people attending than last year. We made history by hosting the biggest investment event in Israel, with 6,000 registered guests from 82 countries, including startups, venture capitalists and strategic investors. Also in attendance were over 200 multinational corporations including Honda, Innogy, GE, Shell, Intuit, Microsoft, and Samsung Ventures.

Jon Medved: This year was bigger and better than any of our previous years, with twice as many people attending than last year. We made history by hosting the biggest investment event in Israel, with 6,000 registered guests from 82 countries, including startups, venture capitalists and strategic investors. Also in attendance were over 200 multinational corporations including Honda, Innogy, GE, Shell, Intuit, Microsoft, and Samsung Ventures.

We focused on successful partnerships already in place between some of these multinationals and the startups they are working with. Companies like Honda and Vocal Zoom demonstrated their optical voice control tech for cars, Mobileye and ZoomCar demoed advanced collision avoidance systems currently being deployed in 10,000 vehicles in India.

In general the quality and quantity of demos was unlike anything we had done before. In booths and on stages and even in a special purpose “demo theatre” there were almost 100 cutting edge technologies to touch and feel and play with. This gave you a real sense of what the future is about to bring to all of us.

At the summit, we also highlighted our continued growth in Asia, announcing the strategic partnership with Shanghai Commercial & Savings Bank (SCSB). The partnership effectively made it Taiwan’s first bank to invest in an overseas FinTech equity crowdfunding platform. We were so thrilled to see the OurCrowd global network come together in one place at one time. This was living proof of the dynamism in the global equity crowdfunding market.

Erin: How do you plan to continue to build OurCrowd and its global summit? What’s in store for next year? What are your predictions for the crowdfunding sector in 2017?

Jon Medved: The next year is set to be even more exciting as the crowdfunding sector continues its rapid growth forecast. We’re in line for further partnership announcements, so stay tuned. Some of my predictions for what’s in store for next year include large funding momentum coming from Asia/Pacific region; pioneering investments in new areas including Machine Learning, Robotics, Agtech, SportsTech, and Digital Health; voice driven apps; and advancements in autonomous driving.

Erin: As one of the leading crowdfunding platforms in the world, how is equity crowdfunding changing today?

Jon Medved: Equity crowdfunding is becoming a more viable, accessible and attractive option for non-institutional investors in sectors that affect everyday life. Global connectivity, has meant that startups have greater entrée to investors from diverse geographies outside the traditional tech hubs, effectively strengthening the democratization process and diversifying the investor mix.

Jon Medved: Equity crowdfunding is becoming a more viable, accessible and attractive option for non-institutional investors in sectors that affect everyday life. Global connectivity, has meant that startups have greater entrée to investors from diverse geographies outside the traditional tech hubs, effectively strengthening the democratization process and diversifying the investor mix.

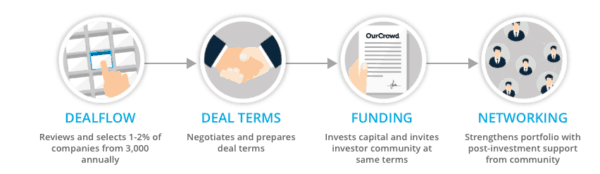

Perhaps the most interesting and significant change is that this access is becoming dynamic and broad-based with platforms like ours, where more than just money is at stake and where the entire global network benefits. By facilitating the connections between the players, portfolio companies can get support on everything from recruitment to market outreach, multinationals gain first looks at new technologies, other venture capital firms gain partners for research and investment, and on and on. It’s no longer a zero-sum game. The network itself adds value.

Erin: OurCrowd continues to ink a growing number of partnerships. Is this to solidify deal flow?

Jon Medved: It’s absolutely vital that we establish new partnerships in order to grow and identify new opportunities. Our partnerships give us access to better quality deal flow, but also to deep expertise in particular fields. Aside from that, we have various other things we are working on with some partners that we aren’t discussing publicly.

Erin: You recently launched Qure as a diversified Digital Health Fund. In which other sectors do you expect to create funds?

Jon Medved: As you said we recently launched OurCrowd Qure – Israel’s first digital health fund ($50M), home to 15 early stage digital health companies revolutionizing the medical industry, including Zebra Medical, Dario Health and KolGene. This fund has a strategic partnership with Johns Hopkins, who are really adding spectacular value to this area.

Jon Medved: As you said we recently launched OurCrowd Qure – Israel’s first digital health fund ($50M), home to 15 early stage digital health companies revolutionizing the medical industry, including Zebra Medical, Dario Health and KolGene. This fund has a strategic partnership with Johns Hopkins, who are really adding spectacular value to this area.

We just launched on the platform a new fund called Maniv Mobility, which is Israel’s first fund dedicated exclusively to transportation innovation with 13 leading cartech companies. This week’s announcement that Intel bought the local hometown Jerusalem company Mobileye in a $15.3B deal makes this fund more relevant than ever.

We have OurCrowd First, Israel’s premier seed-stage venture fund, which having built a portfolio of 15 companies in its first fund is expected to launch soon a second fund on the platform. We have also launched an index fund OC50 which gives you exposure to 50 companies via one investment.

We’re also looking at other areas to have sector funds — ranging from machine learning, robotics, drones, and sportstech. Please stay tuned.

Erin: One of the characteristics of OurCrowd is the post-investment community and the support provided to early stage companies. How does this work? How do you expect this portion of your platform to grow?

Jon Medved: OurCrowd provides post-investment support to all its portfolio companies, we assign industry experts as mentors, and take board seats to those who wish gain from our guidance. We’re pretty hands-on and make sure our existing network helps and builds those early stage companies. The 2017 OurCrowd Global Investor Summit is a prime example of this. There were hundreds of connections made, and deals done over waffles (we ate 2400 of them—and let me tell you, they were good!), and beer, as we closed the summit with one of Israel’s leading groups the Dag Nahash.

Jon Medved: OurCrowd provides post-investment support to all its portfolio companies, we assign industry experts as mentors, and take board seats to those who wish gain from our guidance. We’re pretty hands-on and make sure our existing network helps and builds those early stage companies. The 2017 OurCrowd Global Investor Summit is a prime example of this. There were hundreds of connections made, and deals done over waffles (we ate 2400 of them—and let me tell you, they were good!), and beer, as we closed the summit with one of Israel’s leading groups the Dag Nahash.

Erin: We know you have registered a good number of exits. Can you share overall portfolio returns for your investors?

Jon Medved: OurCrowd already has thirteen exits to date, two IPOs and eleven acquisitions. We don’t release specific returns yet to the public but we think the quality and performance of our portfolio more than speaks for itself. Your readers are welcome to take a look at the companies here.