On Monday, equity crowdfunding platform Seedrs announced it was introducing digital tax certificates and the new tax documents page to investors. According to the funding portal:

“After a Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS) qualifying business raises investment on the platform our team completes the SEIS/EIS3 certificate from HMRC and sends it to each investor by post as quickly as possible. This process works, but it has some inconveniences and is really inefficient. Investors need to keep paper tax certificates in safe locations to make sure they don’t get lost. And if investors defer or forget to claim their reliefs, or to give the information to their accountant, they need to hand in paper certificates in person to their advisor or send them through post mail at extra cost. The reality is that paper tax certificates are only needed when HMRC explicitly requests them, and the information contained in them is only needed when filling in the claim form, e.g. when there are capital gains. Posting paper certificates that aren’t actually needed doesn’t seem efficient for investors or for us (we would much prefer to re-invest the saved postage costs into providing entrepreneurs and investors with a better, more convenient online experience).”

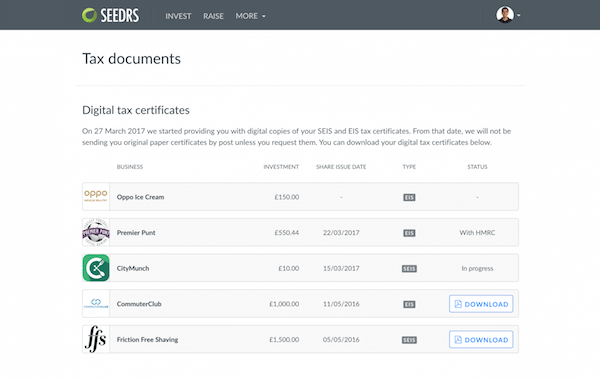

Seedrs noted, starting today, tax certificates will be delivered digitally and will be made available in the new tax documents page. Investors will be notified when new certificates are made available for download.

“Investors no longer have to worry about keeping paper certificates in safe locations or posting them to accountants, as they are now conveniently downloadable from the tax documents page, anytime, anywhere. Digital tax certificates, however, don’t replace paper certificates. Investors who fall into one of the conditions that require paper certificates can still request them from us by email.”

The platform went on to add:

“Seedrs’s mission is to deliver the best experience to our investors. One way we hope to continue doing this is to make the tax documents page the home of tax information related to investments (UK only for now). Investors will soon see their end of year tax statements in this area too. We hope that you find this new feature useful. As always, please let us know if you have any questions or feedback.”