France: Autorité des Marchés Financiers (AMF) Ensures Retail Investors are Informed on Fees for Financial Products

The Autorité des Marchés Financiers (AMF) has released an informative update for professionals on the terms they should use in order “to make it easier for their customers to understand and compare fees.” The AMF has launched a new section on fees on its official… Read More

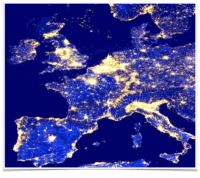

Read more in: Fintech, General News, Politics, Legal & Regulation | Tagged amf, autorite des marches financiers, europe, investments, investor protection, investors, Marie-Anne Barbat-Layani