On 8 November 2017, the French Crowdfunding Association Financement Participatif France released the common set of performance indicators that member platforms specializing in loans, mini-bonds (a debt instrument specific to SME lending marketplaces) and bonds are invited to publish.

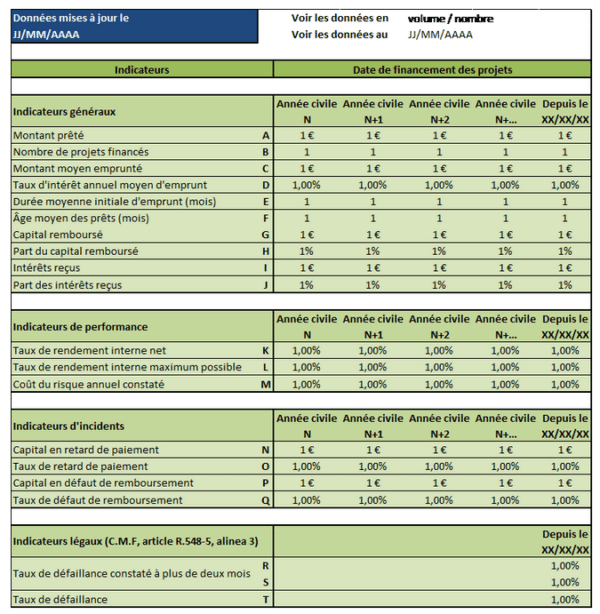

Wishing to go beyond the legally required indicators, the platforms have adopted a series of consistent indicators which will help the industry and the public to better understand they activity and compare their performance. These indicators standardize the calculation and reporting of lending activity, gross interest rates, default rates, net interest rates and internal rates of return. In particular, these indicators will help retail investors understand the actual cost of risk, the impact of defaults on net returns. The indicators are presented by year of origination to allow year-on-year comparisons as well as comparisons with other financial investments.

Wishing to go beyond the legally required indicators, the platforms have adopted a series of consistent indicators which will help the industry and the public to better understand they activity and compare their performance. These indicators standardize the calculation and reporting of lending activity, gross interest rates, default rates, net interest rates and internal rates of return. In particular, these indicators will help retail investors understand the actual cost of risk, the impact of defaults on net returns. The indicators are presented by year of origination to allow year-on-year comparisons as well as comparisons with other financial investments.

“Our objective is to allow a comprehensive and transparent reading of our indicators in order to facilitate the understanding of this new investment and enable reliable comparisons between the different platforms. Our approach is educational. It is quite unique in the field of financial investments. We want to help French retail investors to understand the risk that is inherent to crowdlending and to avoid the two extreme attitudes of excessive optimism and overestimating the impact of defaults.”

Key indicators give a clear picture of crowdlending risk and its cost:

- The share of borrowed capital already repaid. The older the loans, the higher the portion already repaid.

- The portion of interest due already paid. The older the loans, the higher the share of interest already paid.

- The net internal rate of return representing the annual profitability of the loans, net of known or proven losses at the date of calculation.

- The maximum possible internal rate of return representing the annualized yield of loans if all loans were repaid in accordance with the original schedule.

- The annual cost of risk represents the decrease in profitability caused by delays and defaults relative to the maximum possible rate of return. This is the difference between (4) and (3).

All lending platforms are invited to publish these indicators on a dedicated page of their website, with a daily update. Activity data is reported in volume and number of loans.

Benoit Granger, vice-president Financement Participatif France in charge of Ethics added:

“The publication of these indicators will now be part of the Code of Conduct of Financement Participatif France which member platforms adhere to. “

Financement Participatif France is a professional crowdfunding association in France which gathers 150 members including seventy crowdfunding platforms. Created in August 2012, its objective is the representation, the promotion and the defense of the rights and interests of crowdfunding and crowdlending platforms in order to advance French citizens’ access to funding.

The complete set of indicators can be found here (in French)

Therese Torris, PhD, is a Senior Contributing Editor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Therese Torris, PhD, is a Senior Contributing Editor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.