The Crypto Invest Summit (CIS) in Los Angeles this week, rebranded from previous “Crowd” events, was a standing room only conference this year. Organizers sold out of tickets in the last weeks as demand was high for the cryptocurrency / blockchain focused gathering. More than 4500 individuals registered to attend with many sessions beyond capacity as  interest in digital assets has rocketed globally.

interest in digital assets has rocketed globally.

In fact at times it was a too much of a good thing as long lines frustrated some attendees who did not decide to queue up early to beat the crowd. But these hiccups will be ironed out in the future as CIS seeks to be the biggest event of its kind on the West coast – and, perhaps, in other cities at some point in the future.

At this year’s CIS event there were a good number of familiar faces but so many more new ones as online capital formation has added a new path and blockchain continues to disrupt a diverse selection of business models with the distributed ledger technology. While the current regulatory environment was a persistent topic, and a nagging concern the US is falling behind, the recognition that the crypto revolution is an ongoing global disruption was the most important theme of all.

Below, CI shares a selection of just a few of the thoughts and comments we heard at CIS 2018. We look forward to CIS 2019.

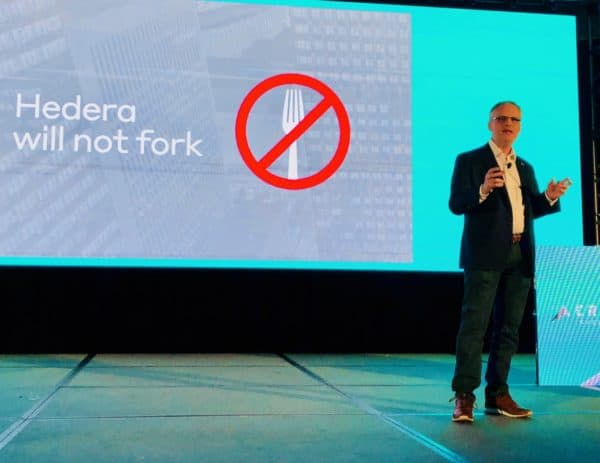

“We are making a promise to the market this platform will never fork.”

“Visa has on average 2000 transactions per second. Hashgraph can do 50,000 transactions per second … 250,000 transactions per second in 2 regions.”

Mance Harmon, Hedera Hashgraph

“We invest in startups and we seem to have gotten really interested in Crypto at an early stage. It is going to change the world.”

“If you are a regulator and just look at securities, then everything is a security. But most of these are just currencies. I say that at some crowds and I get a dead audience.”

Tim Draper, DFJ

“Government vs. crypto-community? I would bet on the crypto-community every day.”

“Banking you just want it to work and it doesn’t. All I want is better service.”

“I want to own wherever the value is going to be. If it is the company then I want to own the equity. If it is the service, I want to own tokens.”

Adam Draper, Boost VC

“The only people that were up in the last four months were people that shorted the market. The vast majority of hedge funds are down right now.”

Jeremy Gardner, Augur

“This is not something different. This is just the next turn in the capital markets world.”

“What we do need is some level of certainty. If the legislative and executive branch are not going to give answers then we need the judiciary to act.”

James Haft, CryptoOracle

“The chairman of the [Mexican] central bank said there are about 300,000 investment accounts in the whole country… if you can use [Abra] this to allow Mexicans that have reasonable savings to put that money into US stocks …. that is a huge breakthrough for [Mexico].”

“I need to put the bank in the consumers pocket to get around the [bureaucratic] nonsense i was dealing with around the world.”

Bill Barhydt, Abra

“The number one struggle that i see … a lot of these teams come from a startup mentality. You have to have a lot of confidence that team can build a company quickly and execute on product.”

“I actually see a lot more opportunity outside the US due to the accessibility question.”

Koh Kim, Crypto Advisor

“… at a zero cost transaction companies can now start serving the lower end of the pyramid.”

Ryan Scott, ICO Impact Group

“If you are not hiding anything you should not be afraid of the SEC … Hopefully they are coming up with some regulations.”

Susan Akbarpour, Mavatar

“… many of the tokens will come online and the story of the token will be less impressive than what was sold.”

Simon Bogdanowicz, Blockteam Ventures

“I can push 500 million messages a second … We are talking about incredibly volume.”

“Satori is going to read and write the internet in real time.”

Gabe Leydon, founder and CEO of Satori

“The SEC is kind of screwed up in letting people decide that it is a Utility or Security. You can have 100% utility token that is still a security (depending on how you market it).”

Jor Law, Homeier Law PC

“Why not let people gamble? Why not let them take a chance on price?” Why not let them gamble on a token? Why create a class barrier?”

Kurt Kumar, Capilarity

“the dichotomy is DEX [decentralized exchange] vs. CEX [centralized exchange]. The killer app of DEX is basically money laundering.”

Miko Matsamura, Evercoin

“No … we don’t need regulation. Regulation in itself creates a lot of problems in how it is implemented. Stealing is wrong. We do not need the SEC to tell us that.”

“… at some point the onus of protection must be put upon the investor.”

“Bitcoin has been in use since 2009… and now we need the SEC and CFTC to protect us?”

David Bleznak, Totle

“Spice is only the 4th security token … By the end of this year, every provider [security token platform] … everyone of them is going to be overbooked with deals… the few providers out there are already overbooked.”

Ami Ben-David, Spice VC

“YouTube generated $22 billion last year. But how much of that money went to the creators? Without them, YouTube would be worthless.”

Frank Eric Banks, ZEN