Claims by current operators of the Canadian cryptocurrency exchange QuadrigaCX that the company has “lost” cold wallets containing more than $150 million in crypto are being disputed by a researcher at the Zerononsense blog.

Claims by current operators of the Canadian cryptocurrency exchange QuadrigaCX that the company has “lost” cold wallets containing more than $150 million in crypto are being disputed by a researcher at the Zerononsense blog.

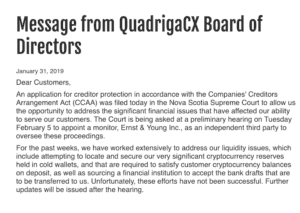

QuadrigaCX filed for creditor protection last week, and according to Zerononsense, an affidavit related to the filing furnished by Jennifer Robertson says Quadriga’s former CEO and Robertson’s husband, Gerald Cotten, who reportedly died in India in December 2018, maintained exclusive control over exchange “cold wallets” (offline crypto storage hardware) storing millions in cryptocurrencies:

“Gerry would move the majority of the coins to cold storage as a way to protect the coins from hacking or other virtual theft…Gerry manually controlled the flow of coins between the hot and cold wallets of the coins credited on the Quadriga platform.”

But Zerononsence claims that, while Quadriga appears to have generated and controlled many “clusters” of hot wallet (Internet accessible) addresses, data shows:

“It appears that there are no identifiable cold wallet reserves for QuadrigaCX.”

As well:

“It appears that QuadrigaCX was using deposits from their customers to pay other customers once they requested their withdrawal.”

Zerononsense says he or she used, “Deposit information from customers…aggregated from the Reddit thread posted above as well as information shared through direct message,” to gather enough transaction data to credibly identify patterns of crypto movement at Quadriga CX.

As well:

“This information was verified independently via chain analysis by checking time stamps, reported amounts, and the flow of transactions from and to known wallet addresses on the Bitcoin protocol, specifically those positively identified as belonging to QuadrigaCX.”

Zerononsense also claims, “only 100% verified transactions with the exchange were consulted.”

If true, the pattern detected by Zerononsence appears to be damning with regards to Robertson’s claims that large pools of crypto were ever manually managed by her husband:

“The key takeaway from the deposit information provided by customers is that QuadrigaCX more than likely never held enough $BTC to account for the customer funds.”

Instead, Zerononsense data appears to show that users’ deposits were used directly to pay other users’ withrawals:

“The customer withdrawal information related to $BTC transactions on the exchange reflect that QuadrigaCX was clearly re-routing payments from customers to satisfy withdrawal requests from other customers on their exchange, effectively operating a shell exchange or a Ponzi.”

Zerononsense hammers the point:

“More specifically, it appears that the exchange had attempted to create individual cluster wallets for customers at one point in time, yet found itself in a situation (more toward the end of 2018), where customer funds that had originally been apportioned for others were eventually redirected to compensate new customers requesting their withdrawals.”

And rather than emanating from a single or a few cold storage devices:

“…(Transfered) funds were sent from a cluster address that was created no more than 4 hours beforehand.”

That said, it is possible to change the addresses produced by cold wallet devices.

That said, it is possible to change the addresses produced by cold wallet devices.

Zerononsense is not the only researcher questioning Quadriga’s claims of lost crypto cold wallets.

The co-founder of an Ethereum hot wallet company called MyEtherWallet and current CEO of MyCrypto, Taylor Monahan, told CCN yesterday that she checked three main Ethereum addresses used by QuadrigaCX:

“I’m seeing NO indication of Quadriga ever having cold/reserve wallets for ETH.”