Hong Kong may have been slow to join the financial innovation party but what it may have lacked in early awareness has now been made up for in fostering a booming Fintech ecosystem.

Hong Kong may have been slow to join the financial innovation party but what it may have lacked in early awareness has now been made up for in fostering a booming Fintech ecosystem.

The private-public partnership that has fueled sector growth continues to drive interest from global firms. Today, there are Fintech focused offices in both London and San Francisco for a boots on the ground to promote the benefits of locating in Hong Kong.

The Hong Kong Government has launched an HK $500 million (~USD $64 million) fund to develop financial services over the next five years. There is also a HK$5 billion Innovation and Technology Fund (ITF) which boosts the ecosystem.

Charles D’Haussy, Head of Fintech at InvestHK, recently said that Hong Kong is focused on “developing complex systems for banking, finance, insurance, FinTech regulation and market-to-market wealth management activities.”

Speaking to the Bangkokpost, D’Haussy stated:

“Two years ago everyone was talking about competition and disruption where new Fintechs are supposed to replace the banks and insurance companies. Now it is much more about collaboration and renovation of financial services, which is really what Hong Kong is all about.”

D’Haussy added that Hong Kong had an organic Fintech ecosystem built by the private sector but supported by the government. It certainly helps that Hong Kong has long been a recognized global financial center that is now physically connected to mainland China with a fast rail system.

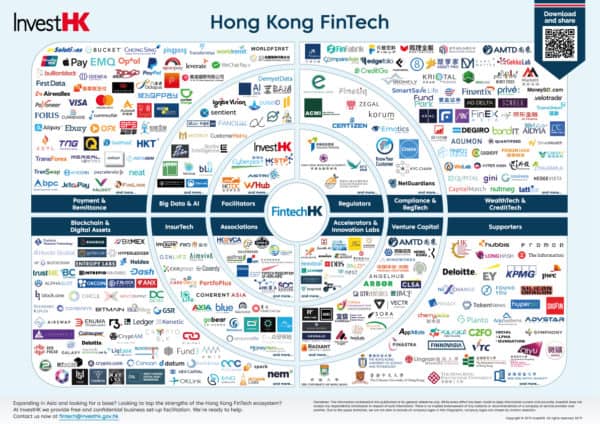

Whatever Hong Kong is doing it appears to be working there are now about 550 Fintechs based in Hong Kong, acccording to InvestHK. While China remains the largest Fintech marketplace in the world, Hong Kong is looking like the bridge where the rest of the world, including Southeast Asia, will connect to the burgeoning sector of finance.