Tokenise is a trading name of Kession Capital Limited, a company registered in the UK and authorised by the Financial Conduct Authority (FCA). The FCA is well known for being Fintech innovationtion friendly. In fact, a recent cohort of their regulatory Sandbox included multiple blockchain based platforms.

According to their website, Kession has a wide range of regulatory permissions, is a listing member of the Gibraltar Stock Exchange (GSX) and a Sponsor Firm for the Gibraltar Blockchain Exchange (GBX).

Kession states that it currently operates as a regulated hosting platform and oversees several clients across the investment management industry, from crowdfunding platforms to the Swiss Stock Exchange.

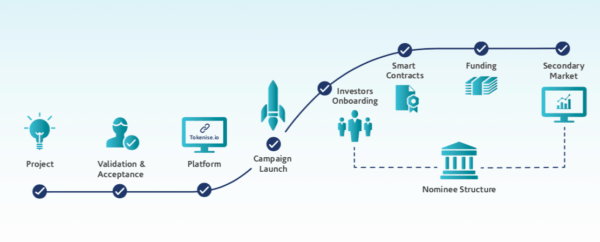

Based in London, the Tokenise platform just recently launched and the company states that participating firms are putting their prospectuses together, ready to offer equity in the form of tokens in their business. Tokenise is the creation of Michael Kessler, owner of Kession Capital, who assisted in the formation of the Gibraltar Blockchain Exchange – a regulated digital asset marketplace.

Crowdfund Insider interviewed Kessler this past week. Our discussion is below.

Why tokenized securities? In your opinion, what is the potential?

Michael Kessler: Tokenisation of securities has significant potential and has the capability to significantly disrupt traditional securities. The reasons for Tokenising securities are many; here are a few of them: heightened technology security, immutable ledger, and record of ownership, tokens are more easily tradeable and are a digital asset representing the underlying security. Tokenise improves data management, streamlines processes and speeds up the settlement times to T+0. This, in turn,n leads to reduced costs, increased auditability and a reduction in fraud through improved KYC / AML procedures.

However, the benefits are not limited to these.

However, the benefits are not limited to these.

The tokens also represent the underlying assets and a smart contract (the token) governs those rules. It is, therefore, possible to tokenise any asset, be it an equity, bond, royalty, fund, fractional ownership, a securitisation of assets or create interesting hybrids that suit the needs of the issuers and investors.

Private Equity members interest can be tokenised to provide liquidity with that vesting interest sold to multiple parties. Fractional ownership of property, artwork, aeroplanes, and wine is also possible.

Securitised products and services that are facing greater regulatory hurdles can also be tokenised and made more effective. Plus, hybrid models using a range of the above – such as royalties and drag and tag options – can be created.

By tokenising a security and placing it on a blockchain it is possible to significantly reduce the cost of trading securities as the blockchain provides the security and immutable record required for two non-trusting parties to trade that security. Furthermore, by dematerialising the asset, the speed of transactions can be increased – and it can reach a wider market of potential investors.

It is estimated that by 2024 $8.1trillion worth of assets will be tokenised – therefore the potential is significant in a fast evolving and growing marketplace.

You assisted with the Gibraltar Blockchain Exchange. Can you elaborate on your involvement?

Michael Kessler: Kession Capital Limited, which trades as Tokenise, is the first UK Listing Member of the Gibraltar Stock Exchange (GSX), in 2017 we helped raise some capital for the GSX and at the time of completion we worked together to help with the workflow and buildout of the Gibraltar Blockchain Exchange (GBX) and we were amongst the first cohort of sponsor firms for the GBX.

You say that Tokenise is FCA regulated – correct? What does this accomplish for your platform?

Michael Kessler: Tokenise is a trading name of Kession Capital Limited, which has been FCA authorised since 2012.

We have over the years acted as a regulatory host for a number of crowdfunding platforms as well as other clients.

Due to our in-depth understanding of the regulations and compliance, we are able to offer a platform that works within the confines of the regulations but build out what we believe is the new iteration for crowdfunding.

By working with our regulated custodian partner firm, we are able to offer a full system with the ability to exit an investment in the crowdfunding space via a bulletin board and enable a secondary market trade to take place. This enables people to potentially exit their investments when they want to.

What about issuers? How are you sourcing and are you focusing on any industry sector?

Michael Kessler: Tokenise has a number of companies that are looking to issue. We are sector agnostic, but the majority of the expected issuers will be from a tech perspective and several will use blockchain technology within their business.

In addition, we have a number of companies that we are associated with whereby we have a very close relationship and they will also act as a source for deal flow.

The UK has the most robust crowdfunding marketplace in the world. How will you compete with the likes of Crowdcube, Seedrs, and SyndicateRoom?

Michael Kessler: Unlike all the other platforms, which have their own distinct advantages and leading places in the community, Tokenise is offering a new form of security product with tokens.

We believe this will appeal to the technology sector and those involved in blockchain technologies as they are more familiar with the process. We also intend to operate a bulletin board which will provide a secondary market, enabling investors to exit an investment and those that want to purchase those securities to do so. This encourages greater price discovery and transparency as well as greater liquidity than is currently available to most investors.

Further to this Tokenise is looking at how it can facilitate a company to go through the steps towards an IPO and a listing on a stock exchange.

Further to this Tokenise is looking at how it can facilitate a company to go through the steps towards an IPO and a listing on a stock exchange.

We will, therefore, provide documentation templates to fundraisers to help in that process and a more standardised robust model to assist the fundraisers and offer more protection to both the fundraisers and the investors.

Tokenise is also working with other jurisdictions and regulators to create an infrastructure that will enable issuers to list on a stock market, thereby creating greater liquidity pools and a more diversified investor base from different countries.

The £300 million UK crowdfunding market we believe over time will be dwarfed by the tokenised securities market and therefore we want to provide an end-to-end solution that is easily accessible to investors and issuers and be a small cog in that large tokenised securities wheel.

Tokenise will incorporate a secondary market. How will this work? How will you provide liquidity?

Michael Kessler: Tokenise is working to create a bulletin board for investors who are looking to sell their investments and avoid the lock-ins that most experience today. We will not provide liquidity ourselves but by creating an active community and by curating the deal flow we hope that some of the issuers of today become the unicorns of tomorrow and therefore the network effect and the ability for people to buy and sell the tokens will allow people to cash out before the company has an exit event.

What about Brexit and the European market?

Michael Kessler: Tokenise is aware of the risks linked with Brexit but unfortunately we have no real idea how things will transpire. There are also fairly strict rules within the other EU countries as to marketing crowdfunding opportunities. We do not necessarily see this as a barrier, although we currently have the ability to market throughout the EU.

We see the primary market coming from the UK and we do not intend to actively market outside the UK. If an investor wishes to invest from outside the UK as long as they are not in breach of the regulations, we see no problem – so long as they go through the onboarding process and demonstrate they can work within the confines of the UK regulations and their own country-specific regulations.

What are your expectations for Tokenise for the coming year? Any estimates on deal flow and volume?

Michael Kessler: Our focus for 2019 is to grow our UK crowdfunding capability.

We have targeted circa 1-2 deals coming through per month and we already have a pipeline for the next 3-6 months. In terms of volume, we expect that some entities will want to go up to the 8 million Euros in raising capital but we expect the majority of deals to be circa £1-2 million raises. We have the first three fundraising opportunities on our site already and are focused on growing this number.