The London Stock Exchange (LSE) has collaborated on the first securities based on blockchain technology.

The LSE is one of the largest regulated exchanges in the world and the second largest by volume operating in Europe (Euronext is first). A report in the Telegraph said that Fintech 20/30 has issued around £3 million in tokenized equity, and settled on the LSE’s Turquoise platform, described as a test environment. The security issuance is the first of its kind for the stock exchange. 20/30 is a Fintech that was part of the Financial Conduct Authority’s (FCA) Fintech Sandbox and thus well known by regulators. Globally, the FCA has become a recognized leader in supporting Fintech innovation.

The tokenized shares were said to be “settled in a test environment on the LSE’s Turquoise equity trading service.” Blockchain startup and digital investment bank Nivaura assisted with the security offering.

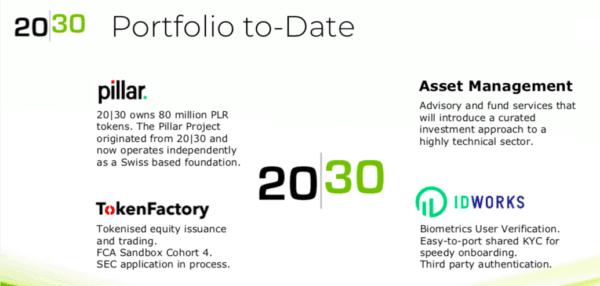

20/30 is a portfolio of diversified blockchain based products and services. The venture studio states that projects launched by their platform will become part of their portfolio.

Current portfolio projects include: Pillar, TokenFactory, IDWorks and Asset Management. TokenFactory is a token issuance and trading platform and is expected to be used to issue security tokens going forward. According to information received by Crowdfund Insider, TokenFactory has an application in process with the Securities and Exchange Commission which may mean it is seeking to become an alternative trading system (ATS).

The pre-sale of the security tokens began in February 2019. Six million tokens were said to be issued at a £0.50 per token price (£3 million) with a post-money valuation for the company of £50 million.

The pre-sale of the security tokens began in February 2019. Six million tokens were said to be issued at a £0.50 per token price (£3 million) with a post-money valuation for the company of £50 million.

A second sale is said to be in the works later in 2019. At that time, 13 million tokens may be issued at a per token price of £1 each and a post-money valuation of £100 million.

It was reported that holders are subject to a one-year lock up before the tokens can be traded. The tokens will first be open only to institutions and not available for retail investors.

The issuance, and subsequential trading, of a security token on the LSE is a benchmark event. While blockchain tech has endured considerable hype and unfortunate fraud, largely due to the initial coin offering odyssey, supporters continue to advocate on behalf of the tech’s ability to streamline financial services with the ability to code features and characteristics into issued tokens. Proponents predict that, at some point in the not so distant future, all securities will become digital thus eliminating much of the back office operations affiliated with securities while enabling a new era of securitization for a greater range of assets. 20/30 emphasizes the compliant and regulated nature of their security token.

The US Securities and Exchange Commission (SEC) has been hesitant to embrace issuers that leverage blockchain tech but the demand and interest is far too hard to ignore. Recently, the SEC provided guidance on security tokens, or digital assets, and expectations are that more issuers will pursue STOs in the coming months.

The US Securities and Exchange Commission (SEC) has been hesitant to embrace issuers that leverage blockchain tech but the demand and interest is far too hard to ignore. Recently, the SEC provided guidance on security tokens, or digital assets, and expectations are that more issuers will pursue STOs in the coming months.

As quoted in the Telegraph, 2030 CEO Tomer Sofinzon stated:

“Tokenisation will unlock value in a whole range of assets, from existing shares to new issuance, bonds, property, IP, fine art and much more.”

20/30 was conceived by David Seigel, Rob Gaskell, and Sofinzon. Seigel is said to be on his 24th startup and was previously a candidate to become the Dean of Stanford Business School, according to the company. Seigel and Sofinzon previously helped to raise $20 million for Pillar.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!