Tink, a Sweden-based fintech that provides APIs to create next-generation banking services, recently announced the launch of its new business account aggregation service. Tink revealed that by fetching real-time business data that was not easily accessible before, aggregation improves company efficiency and productivity, as well as removes friction from onboarding and KYC processes.

“You can make faster, better informed decisions because they are data-driven, and protect against fraud by being able to verify account holder ownership. Because the data is coming directly from the users’ banks, you can trust it. Ensuring business data goes through a ‘cleaning process’ means it is always relevant and accurate, and presented in a readable format that’s easy to work with. For instance, when we fetch business transaction data, Tink removes duplications and details that add no value, and cleans up the data so it’s simple to understand.”

Tink further explained that the data is continuously updated in the background up to four times a day, with rolling consent from the account holder, so your decisions and services are always based on fresh information, from multiple accounts and sources.

“The real upshot is that getting started is quick and simple for everyone. Business account aggregation is currently available in Sweden – and can be tried out by new and existing Tink customers wanting early access, after which it will be included in our enterprise plan. New users can get going right away, whether you have your own PSD2 licence or want to access data through ours, so you can skip the complexity and get straight to developing your service with secure and trusted technology. Tink Link, our front-end SDK, gives you ready-made authentication flows for business account aggregation. With just one line of code, you can connect to the major banks across Sweden.”

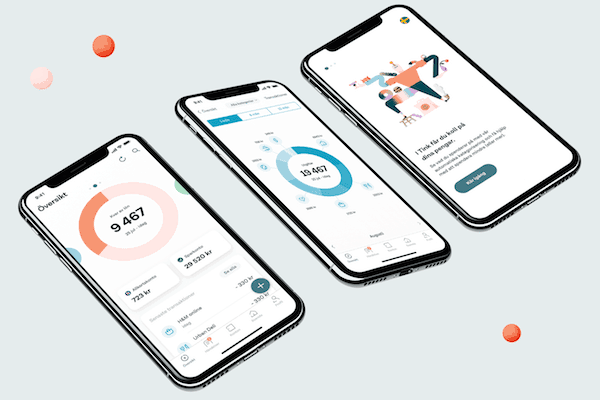

Tink is on a mission to make banking “better” by creating technology to improve customer experience and bring more financial clarity.

“Today, we are an FSA-regulated partner to big banks, fintech unicorns and even small startups. Our 150 employees serve 9 European markets out of two offices. And our API offers one access point to financial data from across Europe – as well as the ability to offer insights and actionable advice – whether it’s through our full-service enterprise offering or our self-service platform for developers.”