Clear Books, which offers accounting and payroll software to more than 13,000 SMEs, has teamed up with payment processing company, Stripe.

Clear Books, which offers accounting and payroll software to more than 13,000 SMEs, has teamed up with payment processing company, Stripe.

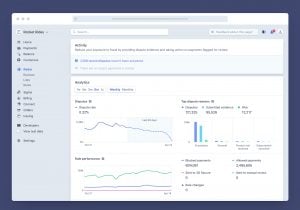

The integration should make it easier or more seamless for Clear Books customers to take card payments, which means that businesses will be able to get paid faster. This can help them stay on top of their accounting.

SMEs that are currently using Stripe will now be able to accept credit and debit payments. They’ll have the option to use Clear Books to import the transaction data into the accounting software.

Businesses may add a “pay now” button to their invoices. When the button is clicked, it will load a Stripe payment form, which will allow companies to accept card payments from clients.

Ruth Fouracre, CEO at Clear Books, stated:

“The integration with Stripe makes it easier for our customers to get paid, and easier for them to do their bookkeeping. The increased pace of new feature development at Clear Books is all about the customer – all our new features are to make Clear Books the easiest-to-use accounting software for small businesses.”

Clear Books is a cloud-based (SaaS) accounting software for SMBs. It’s business offices are based in the UK. In June 2018, Clear Books completed the upgrades needed to become Making Tax Digital ready for VAT. Clear Books reportedly worked with HMRC during the initiative’s pre-pilot and pilot phases.

Clear Books is accredited by the Institute of Chartered Accountants in England and Wales and also by the Institute of Certified Bookkeepers.

In May 2020, digital bank Revolut integrated with Clear Books’ cloud-based accounting system. The feature enables Revolut’s more than 400,000 business accounts to seamlessly view and manage reports and track expenses and bills.