Two weeks ago, the UK Financial Conduct Authority posted a “Dear CEO” letter directed at investment crowdfunding platforms. The letter, signed by Debbie Gupta, Director of Consumer Investments Supervision, cautioned platforms on both the risk of investments being offered to investors as well as the need to mitigate overall platform risk.

Gupta stated in the letter:

“Our objective is to ensure crowdfunding firms promote investment opportunities appropriately so that consumers can understand the risks these speculative and high- risk investments pose. This mitigates the risk of inappropriate investments and reduces the risk of unexpected losses, as highlighted in the FCA’s Call for Input on Consumer Investment, published in September 2020. We also want to ensure that, in the event of failure, a firm can wind down in an orderly manner by having an effective wind down plan and holding adequate financial resources.”

The letter continues to express concern that investors are participating in securities offerings without fully appreciating the risk and while platforms require investors to acknowledge their money is at a heightened risk, the regulator worries that investors “simply click through the process” expressing an opinion that individuals are not necessarily capable of making valued decisions.

The FCA is considering how to boost its rules when it comes to the promotion of these investments – a move that could obviously impact the operations of these online investment platforms as well as the firms seeking growth capital online.

Crowdfund Insider reached out to the UK Crowdfunding Association (UKCFA) for their perspective. A representative shared the following statement:

“The letter was issued to all investment-based crowdfunding platforms on July 2nd and highlighted a number of concerns relating to high-risk investments which were raised in the FCA discussion paper DP 21/1. The UKCFA provided a very detailed and in-depth response to that discussion paper including the survey of more than 2500 customers of member platforms which showed that regulated investment crowdfunding and p2p lending platforms were doing a good job overall of making sure customers understood the risks of investing (and how customers were not supportive of the use of blanket marketing bans on specific product categories such as property investment).

The FCA have since been in touch directly with a sample of platforms to say that they will be carrying out further data collection and analysis (details to be confirmed) to follow up on the evidence provided by the association and understand better the customer perceptions and experience of the regulated crowdfunding and p2p sector.”

The UKCFA shared a copy of the aforementioned survey that provides empirical data in regards to investor participation in crowdfunded securities offerings. So what do people say about the crowdfunding sector?

The survey, which was performed in June of 2021, indicates that customers have a good understanding of the risks and benefits of investing via investment crowdfunding platforms including peer-to-peer lending sites. Just 0.7% of respondents indicated that P2P/crowdfunding represented a low-risk investment – in other words, investors know these can be risky investments.

Just like other asset classes, investors understand that diversification is key to risk mitigation – both across different investments as well as different platforms.

Customers are said to be “strongly opposed” to “mass marketing bans” by regulators for these types of investments.

So in brief, the vast majority of individuals participating in investment crowdfunding understand these can be risky ventures, somewhat in contrast to what the regulators appear to be claiming.

The survey states:

“We do not believe that generalised conclusions should therefore be applied when trying to understand the customer outcomes of specific investment products. The UKCFA would strong argue that the systems and controls which regulate the sector have proven remarkably effective and while there are always improvements based on the findings of the research (particularly customer responses about the importance of risk warnings in supporting informed choice) the perceptions of the sector relative to other financial products would seem to be both accurate and appropriate.”

The UKCFA said the survey results came from over 2500 customers of member platforms offering equity, debt security, and loan-based investments.

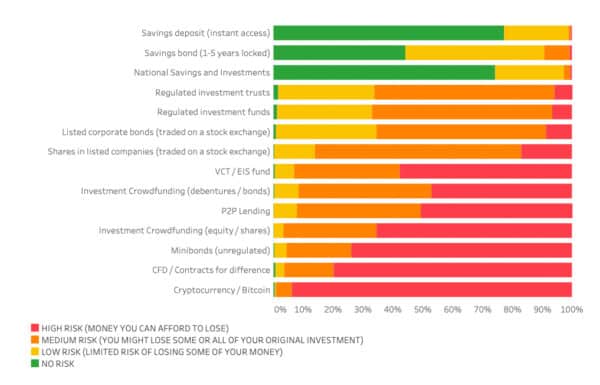

Importantly, UKCFA reaffirms that it has always been “pro-regulation” recognizing that a well-regulated industry builds trust amongst consumers while pointing to the need to enable financial innovation as crowdfunding platforms have introduced a new asset class for many investors. Customers of online investment platforms also are more likely to hold diverse investments. The below graph helps to highlight risk perception from the surveyed audience with equity investors noting these are high-risk investments or “money you can afford to lose.”

While the data appears to strongly support the investment crowdfunding industry and pushes against aggressive regulation by the FCA, anecdotal reports can create a perception that may differ from reality.

A recent case where a Crowdcube investor was awarded compensation by the Financial Ombudsman Service (FOS) for an investment in a firm that failed could be misconstrued as the rule and not the exception. The letter by the FCA that worried that “too many consumers are still investing in inappropriate high-risk investments which do not meet their needs” may foreshadow more restrictions for the crowdfunding sector – restrictions that may not be necessary.

Innovation is always hard – even more so in a highly regulated industry like investment crowdfunding (as well as Fintech in general). And politics can cloud balanced judgment when popular sentiment drives the narrative. The UK Financial Conduct Authority has long been lauded for its forward-thinking approach in empowering financial innovation – a key variable in the UK emerging as the top global Fintech hub. The balance between market risk and regulation will always be a tightrope act but the cost of too restrictive rules could be far greater than the aggregate investment loss in a sector that must be measured by the few successes that emerge over years.