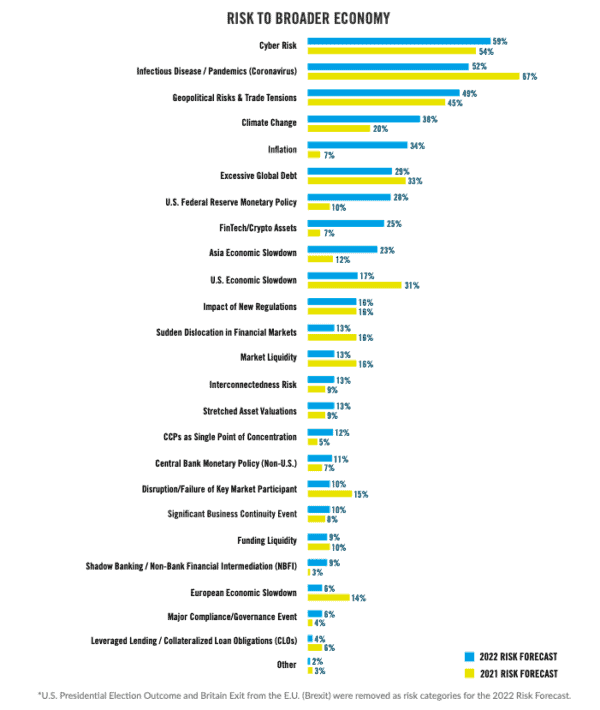

Cyber risk is the biggest threat to financial markets in 2022, according to a statement by The Depository Trust and Clearing Corporation (DTCC). This pronouncement should come as no surprise as the news is replete with reports of hacks and breaches by all kinds of firms and organizations. Cyber issues are followed by concerns regarding infectious diseases (like COVID) and geopolitical risk (like Russia, China, etc.).

Michael Leibrock, Chief Systemic Risk Officer at DTCC, said in a release:

“The survey shows that cyber risk is pervasive; it’s striking to see its impact extend across multiple top threat areas. When describing the pandemic, risk managers stated that it left the industry more vulnerable to cyber-crime. As a result of this and other drivers, it is critically important that firms continue to bolster their response plans, practice simulations, and frequently review their cybersecurity and risk management practices to assess whether they’re staying on top of this evolving threat.”

The Survey states that 24% of respondents cited cyber risk as the top overall threat to the industry, with over half (59%) citing it as a top-five risk.

When it comes to pandemic concerns, 52% of survey respondents believe it is a top 5 risk, a decrease from 67% in last year’s survey – indicating the world is ready to move on from COVID-19.

Geopolitical Risks & Trade Tensions was cited by 49% of respondents as a top 5 risk, an increase from 45% in last year’s survey, reflecting a change in the US administration and recent world events.

Stephen Scharf, DTCC MD and Chief Security Officer, said:

“The complexity of the financial services industry, the interconnectedness of individual players, and the introduction of new and innovative technologies further heighten the risk of a large- scale cyber-attack on the financial sector. That’s why cybersecurity and resilience initiatives are never complete. We must continually assess our security measures against the risks we face.”

Regarding infectious diseases, David Lafalce DTCC MD, Global Business Continuity & Resilience, said the Delta variant of Covid-19 highlights the fragility of supply chains:

“Financial sector firms must take a fresh look at how they can further improve their operational resiliency so they can continue to function and provide critical services under disruptive conditions,” he said adding that operational resiliency will be a strategic priority for firms over the course of 2022.

Ali Wolpert, DTCC MD and Head of Global Government Relations, noted that policy is often driven by unexpected events and DTCC anticipates the impacts continuing to reverberate throughout 2022.

Interestingly, climate change, along with inflation – a growing immediate concern, ranked 4th and 5th followed by monetary policy and Fintech/crypto-assets.

There were some regional disparities in responses and the survey indicates that North American firms are more worried about inflation outside of the continent.

DTCC completed its Systemic Risk Barometer Survey from September 14 to October 11, 2021, with 100 North American respondents along with 116 respondents outside of North America.