The Financial Stability Board (FSB) published a report yesterday on crypto-asset risks.

The FSB is an international entity that promotes global financial stability. As digital assets have grown, the FSB has engaged in the ongoing discussion of the importance and systemic impact of crypto.

The report examines vulnerabilities focusing on three different areas:

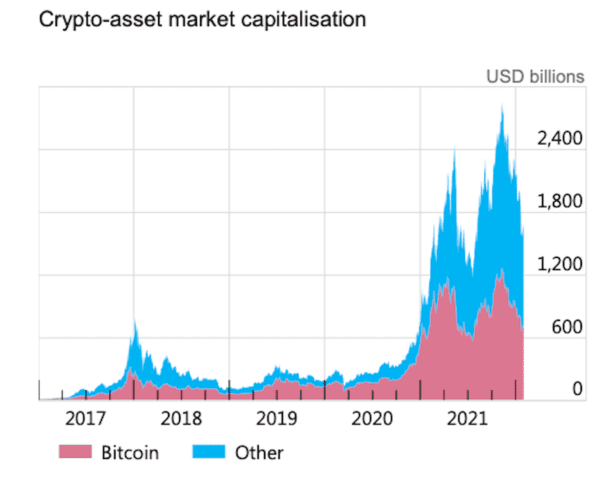

- unbacked crypto-assets (such as Bitcoin);

- stablecoins;

- decentralised finance (DeFi) and other platforms on which crypto-assets trade

According to the FSB, vulnerabilities in crypto markets include increasing linkages between crypto-asset markets and the regulated financial system. This includes liquidity mismatch, credit, and operational risks that make stablecoins susceptible to sudden and disruptive runs on their reserves.

There is a risk that shortcomings impact short-term funding markets. The lack of oversight and opacity of many digital assets exacerbates the concern.

Of course, there are nefarious activities like ransomware, money laundering, etc.

In 2020, the FSB recommended certain approaches to mitigate some of this risk, specifically with the stablecoin markets. The FSB says that it is working, along with other standard-setting bodies, to address threats associated with stablecoins.

In 2022, the FSB will further investigate unbacked crypto assets to address any possible financial stability threats. The FSB states that it will continue to monitor and share information on regulatory and supervisory approaches for the regulation, supervision, and oversight of stablecoin arrangements.

There is a lot to unpack in this report and an excellent aggregation of data points. The report, Assessment of Risks to Financial Stability from Crypto-assets, may be downloaded here.