Affirm (NASDAQ: AFRM), the payment network that empowers consumers and helps merchants drive growth, and Poshmark, a social marketplace for new and secondhand style, announced a 2-year extension and expansion of their partnership “to deliver increased payment flexibility to shoppers.”

Poshmark was one of the first companies “to pilot Affirm’s Adaptive Checkout, which provides shoppers with more flexibility and choice at checkout.”

Today, eligible shoppers from Poshmark’s community of more than 80 million users “can choose between monthly payments or four interest-free payments every other week for all items over $50.”

Adding these payment options through Adaptive Checkout has led to “an increase in average order value and the number of orders at these price points for Poshmark.”

This expanded partnership “comes after Affirm’s Consumer Spend Report revealed more than 1 in 2 consumers are interested in using a pay-over-time solution this year.”

McKinsey predicts annual growth of 10-15% in the luxury resale market “over the next decade, and by 2025 will comprise a third of the total market.”

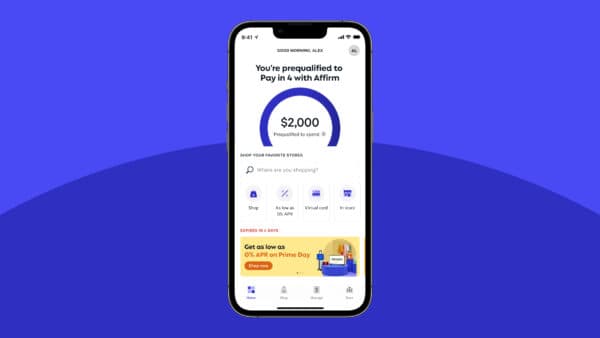

By selecting Affirm at checkout, approved Poshmark customers can “split the total cost of their purchase into biweekly or monthly payments, for as low as 0% APR.” They are “shown the total cost of their purchase and will “never pay more than they agree to upfront.”

Affirm claims that it “never charges customers any late or hidden fees.”

John McDonald, Chief Operating Officer at Poshmark, stated:

“As consumers embrace secondhand and turn to Poshmark for one-of-a-kind styles, great deals and readily available inventory, we’re giving them more flexibility and choice than ever through our expanded partnership with Affirm. More than half of our available inventory is now eligible for Affirm’s payment solutions, and we’re seeing strong uptake of these options, demonstrating just how valuable this offering is to our loyal community of buyers and sellers.”

Silvija Martincevic, Affirm’s Chief Commercial Officer, remarked:

“Consumers increasingly demand flexible payment options, and our latest Consumer Spend Report revealed that nearly half of consumers will only complete a purchase if a retailer offers a pay-over-time at checkout. Our partnership with Poshmark now delivers increased flexibility through a wider range of payment terms, giving consumers more choice to shop their favorite secondhand styles on a budget-friendly schedule.”

Poshmark is one of over 168,000 Affirm retail partners, “including Walmart, Target, Williams Sonoma, American Airlines, and more.”

Offering Affirm at checkout can “drive overall sales, increase average order value, and increase customer repurchase rates.”

As covered, Affirm’s mission is “to deliver honest financial products that improve lives.”

By building a new kind of payment network — one based on trust, transparency and putting people first — they claim to “empower millions of consumers to spend and save responsibly, and give thousands of businesses the tools to fuel growth.”

Unlike credit cards and other pay-over-time options, they claim to “show consumers exactly what they will pay up front, never increase that amount, and never charge any late or hidden fees.”