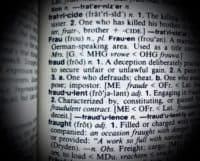

The SEC, FINRA, NASAA Issue Warning on AI Fraud

The Securities and Exchange Commission (SEC) Office of Investor Education and Advocacy, the North American Securities Administrators Association (NASAA), and the Financial Industry Regulatory Authority (FINRA) have jointly issued a warning regarding the rise of investment frauds involving the use of artificial intelligence (AI) –… Read More

Read more in: Artificial Intelligence, Strategy | Tagged finra, fraud, nasaa, sec