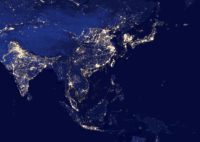

InstaReM Partners with Ripple to Secure Payouts in Southeast Asia

InstaReM, a southeast Asia’s digital cross-border money transfer service provider, has inked a strategic partnership with enterprise Blockchain payment solutions provider, Ripple. According to InstaReM, this partnership will facilitate quick and secure payouts for RippleNet members across Southeast Asia. InstaReM is a Singapore-headquartered cross-border payments… Read More

Read more in: Blockchain & Digital Assets, Asia, Fintech, Global | Tagged instarem, patrick griffin, payments, prajit nanu, ripple