A few weeks back the value of VC’s for the crowdfunding industry was extensively discussed. Why? Because there are lot of areas where crowdfunding and VC’s can connect. And though traditional funding and alternative funding are not as rigorously separated as many want to believe, there are some inherit differences that characterise crowdfunding as a different form of funding.

Tanya Prive in 2012 wrote an article on Forbes describing crowdfunding as “the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet.”. Rachel Chalmers refers to as VC money as “fuel for hypergrowth”. In addition, VC’s are in the business of making money for their own investors. Besides the target audience (crowd vs. VC) there doesn’t seem to be clear difference if we look at equity crowdfunding.

Tanya Prive in 2012 wrote an article on Forbes describing crowdfunding as “the practice of funding a project or venture by raising many small amounts of money from a large number of people, typically via the Internet.”. Rachel Chalmers refers to as VC money as “fuel for hypergrowth”. In addition, VC’s are in the business of making money for their own investors. Besides the target audience (crowd vs. VC) there doesn’t seem to be clear difference if we look at equity crowdfunding.

In both cases the investor profits financially, entrepreneurs are requested to deliver certain information and investors need to be convinced. Then why worry about the differences? Because, despite being marketed as the go-to Holy Grail of funding, most crowdfunding campaigns fail, only 1 in 10 succeeds on IndieGoGo (according to The Verge’s great article). And not because they were all bad investment opportunities. The problem was marketing.

Timing of the money

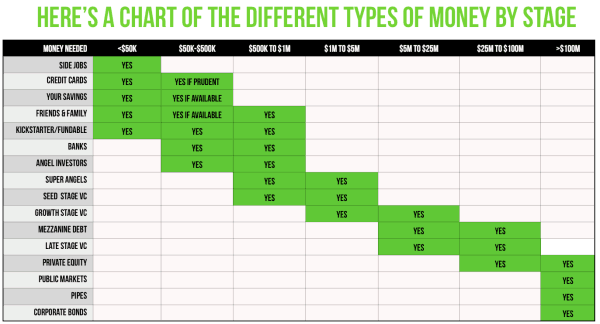

A first, very well visualised differenced can be found via Startup Guide: the timing. As you’ll see the type of funding for each phase varies a lot. Of course there’s some overlap but in general, VC’s won’t invest in anything that isn’t creating revenue yet. Crowdfunding on the other hand, has the reputation to be solely for start-ups. In my everyday job as Symbid‘s proposition manager where I coach the entrepreneurs in their funding, I see very different companies.

Small companies that have been in existence for quite a time (between 5-25 years); film funds that have a million dollar budget but want to do some form of inspiring marketing; individual entrepreneurs who still have to write down their business plan; growing start-ups that come back every year for another round and companies want fast forward their growth, using the money for “hypergrowth”.

Because crowdfunding lets the entrepreneur be in control of their own funding trajectory, it can be used any time they feel the time is right. Of course there are some exceptions (if you have no time for it, then don’t do it), but it is the entrepreneur that is fully responsible for the how and when of the funding process.

Because crowdfunding lets the entrepreneur be in control of their own funding trajectory, it can be used any time they feel the time is right. Of course there are some exceptions (if you have no time for it, then don’t do it), but it is the entrepreneur that is fully responsible for the how and when of the funding process.

The reputation and differences in outcome

Crowdfunding was the first aid kit for capital when no one else will give you money. Crowdfunding is a necessary evil, having a VC is a luxury. But is that true?

Chalmers gives five very compelling reasons why you’d want to stay away from Venture Capitalists as an entrepreneur. In summary, a loss of control and narrowing down business development options. The idea that most successful companies raise money via a VC is a urban legend in Entrepreneurship Town; lots of companies succeed without that money.

Again, via crowdfunding the entrepreneur stays in control for the most part. Though a good VC investment can bring lots of good for a company, the company is a product that the VC needs to make money in. While in crowdfunding, there’s a sense of togetherness, sharing and support backed by money. Different ways of funding your company that have different results and different outcomes for you company. And with all the sustainable, social and consumers as “fans”, one might start to think equity crowdfunding is starting to become the epitome of involving your customer.

Self regulated fund raising as a basis for the process & dynamics

Self regulated fund raising as a basis for the process & dynamics

Entrepreneurs prepare a campaign when starting with crowdfunding, instead of a single pitch that appeals to all VC’s alike. This also means “one at a time” vs. a full blown marketing crusade: that’s a VC funding quest vs. a crowdfunding process. Whereas getting the right network and subscriptions to VC-networks gets the entrepreneur one appointment at a time, crowdfunding requires to think about ways to reach your audiences and target markets as successfully as possible.

Questions like: what am I selling to whom, who is my target audience, is my own network a seperate group, is there a difference between my customers and investors, where are they, how should I address them, should we send out a press release, and so forth are not at all uncommon during crowdfunding. Whereas a entrepreneur wouldn’t send out a press release about his appointment with a VC, nor would he continuously (almost obsessively) update his network about the progress.

Though the information used as a basis of communication (business plan, financial projections, etc.) is often the same, the ideas and literal message are very different. If an entrepreneur decides to root for VC, their business will be tailored for a specific payback. In crowdfunding, the campaign in itself, a small ROI and the opportunity to make something possible, are the expected outcomes.

Instead convincing the VC’s the entrepreneur engages; instead of saying “your investment makes ABC possible” and entrepreneur has to focus on “together we can..”; instead of talking to a superior or someone the entrepreneur is dependent on, they’ll talk to their peers. Crowdfunding is weeks of continued marketing efforts in order to gather funds bit by bit, while VC money are intermittent, singular conversations that aim to get a large amount of money at once. These differences highlight the difference between the characterizing dynamics for each type of funding.

Instead convincing the VC’s the entrepreneur engages; instead of saying “your investment makes ABC possible” and entrepreneur has to focus on “together we can..”; instead of talking to a superior or someone the entrepreneur is dependent on, they’ll talk to their peers. Crowdfunding is weeks of continued marketing efforts in order to gather funds bit by bit, while VC money are intermittent, singular conversations that aim to get a large amount of money at once. These differences highlight the difference between the characterizing dynamics for each type of funding.

Investment marketing

In short, whereas VC’s money is hauled in by “closing the deal” and single selling moments, crowdfunding really is investment marketing. If we look at the dynamics during the campaign I could swap “the company” for any other product and it wouldn’t be called “crowdfunding” but “marketing”. Analysing and setting up various campaigns, the 4 (or 7) P’s are a great way to make entrepreneurs think about what they’re selling and how they’re attracting enough customers, emphasizing the strong marketing dynamics that really separate crowdfunding from VC funding raising.

___________________________

Ludwine Dekker has been coaching entrepreneurs in executing their digital fund raising for three years. As a digital marketing specialist, she specializes in entrepreneurship, technology and fund-raising. As a campaign manager at Symbid she strategically manages the entrepreneur’s campaigns and requirements, organizes pitch events, frequently writes for several platforms, and gives workshops.

Ludwine Dekker has been coaching entrepreneurs in executing their digital fund raising for three years. As a digital marketing specialist, she specializes in entrepreneurship, technology and fund-raising. As a campaign manager at Symbid she strategically manages the entrepreneur’s campaigns and requirements, organizes pitch events, frequently writes for several platforms, and gives workshops.