Cyclically, innovation gets the top of the corporate agenda as a growth enabler that can play a major role in replacing existing products or services and in creating new markets, so anticipating future needs and eventually disrupting the current business models.

But the “innovator’s dilemma” (Christensen, 1997, HBR) keep most managers afraid of breakthrough innovation: they are focused on revenues and profits, continuously under pressure from investors and shareholders, and not much attracted by something that customers cannot use yet.

But the “innovator’s dilemma” (Christensen, 1997, HBR) keep most managers afraid of breakthrough innovation: they are focused on revenues and profits, continuously under pressure from investors and shareholders, and not much attracted by something that customers cannot use yet.

Indeed, while during last century the “not invented here” syndrome was quite common, more recently corporate venture capital isn’t working properly (Salter, 1983, HBR) and innovation is increasingly more often bought outside the company then achieved internally, thanks to fresher minds, free to explore without restraints.

The last 50 years have seen at least five waves of innovation driven competitive challenges, always bringing the same dilemma together with the exploration enthusiasm. This is why new entities have often been more effective than large organizations in exploring new concepts, without any concern to protect existing revenue streams.

Each wave of innovation brought new concepts and common mistakes. For example, many large corporations insist on appointing technical management to lead innovation teams, while sometimes HR managers might be more talented in putting resources together and connected with the non-innovation staff. Others keep looking exclusively for blockbusters, skipping smaller innovation that might have created important markets: Time corp. didn’t launch new magazines for years, being focused on replicating the peerless success of People. Another dangerous mistake is the creation of a second class staff population, in charge for the ordinary business and not involved with innovation and the connected salary benefits, privileges and image.

Each wave of innovation brought new concepts and common mistakes. For example, many large corporations insist on appointing technical management to lead innovation teams, while sometimes HR managers might be more talented in putting resources together and connected with the non-innovation staff. Others keep looking exclusively for blockbusters, skipping smaller innovation that might have created important markets: Time corp. didn’t launch new magazines for years, being focused on replicating the peerless success of People. Another dangerous mistake is the creation of a second class staff population, in charge for the ordinary business and not involved with innovation and the connected salary benefits, privileges and image.

In the late seventies, the evolution from mainframes to consumer desktops transformed Silicon Valley garages in the new base for product innovation. While most radical innovation came from new pioneers as Steve Jobs, large corporations as Sony and Toyota forced the U.S. and European giants into a run to remain on the edge.

In the eighties, there was a buyout trend, focused on the discovery of underutilized assets to be acquired and exploited. Instead, in the nineties the internet caused the explosion of the digital mania, imposing a radical business model innovation and many excesses: nobody cared about revenues and profits, being more focused on estimated cash flows, so momentarily killing the innovator’s dilemma.

Then, after the dot-com crash of 2005, large corporations started to refocus on organic growth, and some of them included innovation among their company credo; customers got back to the center of management strategy and giants as IBM found an equilibrate way to deal with exploring the new while exploiting the old.

The last wave of innovation came in 2010, together with the rise of the crowd-economy. Crowd-sourcing, crowd-funding and crowd-innovation are demonstrating how cheap and effective taking advantage of the crowd is.

The crowd is loose and decentralized, but has also enormously different skills and resources and an astounding motivation, seldom found within the corporate staff, which is just moved by salary, bonus and career. It’s true that managing crowd-innovation is very difficult and protecting intellectual property is sometimes impossible, but on the other hand the huge benefit of crowd-innovation is widely documented and it’s becoming a well-established management trend.

The crowd is loose and decentralized, but has also enormously different skills and resources and an astounding motivation, seldom found within the corporate staff, which is just moved by salary, bonus and career. It’s true that managing crowd-innovation is very difficult and protecting intellectual property is sometimes impossible, but on the other hand the huge benefit of crowd-innovation is widely documented and it’s becoming a well-established management trend.

Crowd-innovation is taking four different main shapes (Lakhani, 2013, HBR), each offering different challenges and opportunities, together with far different intellectual property and technology transfer perspectives.

A) Crowd-labor markets match skills and needs, capacity and professional services offers and demand. Upwork (formerly known as Odesk) is a great example of intermediary of this kind, with its half a million registered clients and 2,5 million freelancers generating over one billion dollars of annual revenues, with a very high satisfaction rate (over 90% rehiring customers).

This is the crowd-innovation model which has the closest overlapping with traditional corporation, as it is substantially a way to enlarge the market of hired resources.

B) Crowd collaborative communities involve different challenges: protecting intellectual property is almost impossible as they work combining people, which share ideas and information freely, with the help of technology (usually web platforms). Communities as Wikipedia are able to marshal contributions, tracking, coordinating and patrolling the community’s database. Google has chosen this way for the development of the Android operating system, which is indeed free and open and has no IP restraints; instead, the research algorithm which is Google’s cash cow is well beyond the crowd reach, protected by Mountain View innovation leader.

B) Crowd collaborative communities involve different challenges: protecting intellectual property is almost impossible as they work combining people, which share ideas and information freely, with the help of technology (usually web platforms). Communities as Wikipedia are able to marshal contributions, tracking, coordinating and patrolling the community’s database. Google has chosen this way for the development of the Android operating system, which is indeed free and open and has no IP restraints; instead, the research algorithm which is Google’s cash cow is well beyond the crowd reach, protected by Mountain View innovation leader.

A similar approach was taken by IBM far before the crowd-economy was born: in 1998 they moved the web server infrastructure development from their internal resources to Apache, an online community of webmasters; then, in 2000 IBM launched a one billion program over three years to support the development of Linux.

C) Protecting intellectual property is instead possible when the strategy is that of crowd contests: when launching competitions it is possible to generalize and extract a problem from an organization, abstracting and making it understandable, without sharing the whole internal development achieved and protected intellectual property details.

Kaggle is a predictive analytics crowdsourcing platform, where Merck opened a crowd contest to streamline its drug discovery process: the pharmaceutical company released some handpicked data on chemical compounds previously tested, asking participants to identify the most promising of them. The computer scientist who won the competition had nothing to do with pharma and his machine learning approach gave him a front page article on the New York Times, beside the $40,000 prize that he earned prevailing on the 238 teams and 2500 proposals collected by Merck in just eight weeks.

Kaggle is a predictive analytics crowdsourcing platform, where Merck opened a crowd contest to streamline its drug discovery process: the pharmaceutical company released some handpicked data on chemical compounds previously tested, asking participants to identify the most promising of them. The computer scientist who won the competition had nothing to do with pharma and his machine learning approach gave him a front page article on the New York Times, beside the $40,000 prize that he earned prevailing on the 238 teams and 2500 proposals collected by Merck in just eight weeks.

This is the typical example of innovation that would have never come from the internal R&D because of the dramatically different and breakthrough approach that only an external resource is free to have.

D) The fourth crowd-innovation model is that of crowd complementors, who sell their products to the customer of the core product, so making it more useful and expanding his demand. The crowd is involved by creating a platform that generate innovation for the core products and that beside increasing utility, produces revenues or licensing fees.

In this model intellectual property may be protected by API (Application Programming Interfaces) and developers agreement, which are currently accepted as industry practice.

This model became familiar with the App Store and it is most effective when a high variety and quantity of complements creates value for the core product.

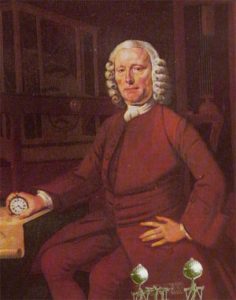

To be honest, crowd-innovation is not that new and it has very ancient roots: in 1714, for example, the British Parliament used a crowd contest to solve the problem of the exact triangulation of locations at sea: the £15,000 Longitude Prize was won by a John Harrison, a country clock maker who was capable of finding a solution that scientists as Isaac Newton missed. What is new is the possibility to exploit crowd-innovation through instruments that facilitate the sharing of information and disintermediate the processes, so cutting edges of long and expensive processes and getting the most advantages from great available innovation opportunities.

To be honest, crowd-innovation is not that new and it has very ancient roots: in 1714, for example, the British Parliament used a crowd contest to solve the problem of the exact triangulation of locations at sea: the £15,000 Longitude Prize was won by a John Harrison, a country clock maker who was capable of finding a solution that scientists as Isaac Newton missed. What is new is the possibility to exploit crowd-innovation through instruments that facilitate the sharing of information and disintermediate the processes, so cutting edges of long and expensive processes and getting the most advantages from great available innovation opportunities.

(Editors Note: the following presentation was delivered to the Crowd Dialog Europe – Helsinki event which took place on August 27, 2015)

[slideshare id=52138506&doc=helsinki-150827144936-lva1-app6892]

Alessandro Lerro is an Italian attorney and founder of Lerro & Partners. He is a prominent Italian expert in crowdfunding and is a regular speaker in conferences and workshops. Alessandro is also General Counsel of the European Equity Crowdfunding Association and Board Member of AISCRIS. You may follow Alessandro on Twitter @allessandrolerro.

Alessandro Lerro is an Italian attorney and founder of Lerro & Partners. He is a prominent Italian expert in crowdfunding and is a regular speaker in conferences and workshops. Alessandro is also General Counsel of the European Equity Crowdfunding Association and Board Member of AISCRIS. You may follow Alessandro on Twitter @allessandrolerro.