The UK has become one of the hottest markets for FinTech startups in the world. In fact the George Osborne has made the FinTech industry a tentpole in his policy initiatives. At the Innovate Finance launch last year the Chancellor declared “I want the UK to lead the world in developing FinTech”. Some politicians in the UK have recognized the finance industry as one of strategic importance to keep economic opportunity growing and to engender innovative new companies that compete with the old school banking approach. Instead of demonizing the finance sector (as happens all to frequently in the US), policy makers have been more inclined to juice competition to make it better. The UK has led the world in investment crowdfunding, peer to peer lending, and other inventive perspectives on capital formation and investment.

The UK has become one of the hottest markets for FinTech startups in the world. In fact the George Osborne has made the FinTech industry a tentpole in his policy initiatives. At the Innovate Finance launch last year the Chancellor declared “I want the UK to lead the world in developing FinTech”. Some politicians in the UK have recognized the finance industry as one of strategic importance to keep economic opportunity growing and to engender innovative new companies that compete with the old school banking approach. Instead of demonizing the finance sector (as happens all to frequently in the US), policy makers have been more inclined to juice competition to make it better. The UK has led the world in investment crowdfunding, peer to peer lending, and other inventive perspectives on capital formation and investment.

GLI Finance, a participant in the finance industry, has published an “Alternative Finance Manifesto”, outlining what they believe are key recommendations to ensure the ongoing advancement of the sector. The perspective is shared in light of the forthcoming general election where you can be certain there will be numerous policy statements – some valid and some vapor.

Louise Beaumont, Head of Public Affairs and Marketing, GLI Finance commented on the Manifesto:

“The alternative finance sector has played a crucial role in providing much needed finance to high-growth SMEs at a time when they have been consistently failed by traditional lenders. The industry is now a vital part of the credit ecosystem given its unique ability to meet the needs of SMEs, including those businesses operating in a knowledge-based economy.

“It is imperative that, regardless of the makeup of the next government, the momentum that has been generated in the sector is not lost. We have made significant strides in developing a policy framework that has the potential to make a real difference, paving the way for better regulation, higher levels of awareness and opening the sector up more effectively to institutional investors.

“However, such a framework is wasted in the absence of effective implementation and we must ensure that in an uncertain political climate the correct steps are taken to ensure the UK remains a global leader. Getting this right will ensure the successful future of tens of thousands of high-growth SMEs and established corporates who are currently unable to access appropriate finance solutions. These businesses have the power to fuel our economic recovery; a strong incentive for any of the major political parties.”

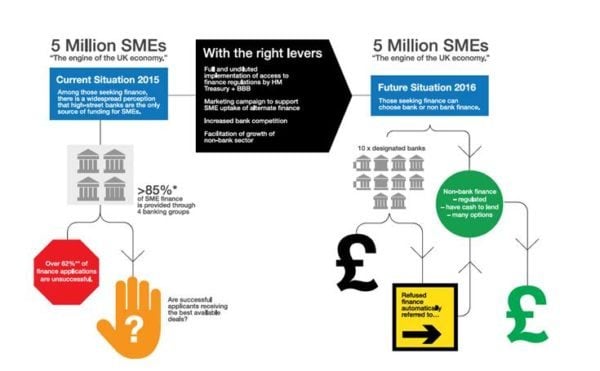

The more than 5 million SME’s in the UK are the engine of economic growth. Politicians and policy makers consistently champion small business, but words need to match actions.

- Keep the British Business Bank empowered & well funded

- Publicize alternative finance to boost awareness of the options

- Create Education programs for professionals and managers

- Speed up the introduction of a Lending ISA

- Maintain and improve tax relief programs such as the SEIS and EIS

Public support is vital for political recognition. While there may be more initiatives that should be added to the list, advocacy means being public in your opinion. We will see if the UK government is paying attention.

[scribd id=261819690 key=key-Tk4GNZu1VIlrhhAYckma mode=scroll]