The United Kingdom has focused great attention and energy on encouraging an economic environment of innovation and entrepreneurial growth. While actions always speak louder than words from a US perspective, we sometimes look with envy at what is occurring the UK and not happening in the US. Granted not all is rosy across the Atlantic but point made: they have offered retail equity crowdfunding for several years now by first allowing the new form of finance to grow unencumbered by regulations. The FCA only “officially” regulated equity crowdfunding this past spring. Peer to peer (P2P) lending is free to grow without inconvenient regulations these platforms endure in the US market.

The United Kingdom has focused great attention and energy on encouraging an economic environment of innovation and entrepreneurial growth. While actions always speak louder than words from a US perspective, we sometimes look with envy at what is occurring the UK and not happening in the US. Granted not all is rosy across the Atlantic but point made: they have offered retail equity crowdfunding for several years now by first allowing the new form of finance to grow unencumbered by regulations. The FCA only “officially” regulated equity crowdfunding this past spring. Peer to peer (P2P) lending is free to grow without inconvenient regulations these platforms endure in the US market.

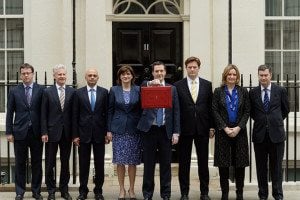

The Chancellor of the Exchequer George Osborne, gave a widely watched speech this past week sharing his vision on the UK and their future competitive position in the world – specifically in the world of finance. Pointedly he wants to be number one in the world of FinTech, establishing the UK as a bastion of innovation challenging financial centers around the globe.

In fact the UK government has partnered with P2P platforms by requesting the British Business Bank to work with several P2P lenders funneling £100 million in their direction. He just announced another £100 million – a step that furthers the wake up call to traditional banks and the challenged model.

In fact the UK government has partnered with P2P platforms by requesting the British Business Bank to work with several P2P lenders funneling £100 million in their direction. He just announced another £100 million – a step that furthers the wake up call to traditional banks and the challenged model.

Christine Farnish, Chair of the UK based P2PFA, said of the speech by Osborne;

Christine Farnish, Chair of the UK based P2PFA, said of the speech by Osborne;

“We very much welcome today’s words by the Chancellor and believe peer-to-peer lending will play a key part both now and in the future for UK SMEs. Our most recent industry figures show business and personal lending is growing with the aggregate flow of funds lent doubling over the last six months. The Small Business Bill is an important step towards ensuring our innovative industry plays a vital part in bringing more choice and competition to the UK financial sector as well as helping create jobs and growth.”

To quote Osborne:

“There is fierce international competition for this growing industry. And you need the right support from government to win this global race – you need the best investment environment, the right tax system, the appropriate regulatory rules, the best infrastructure, and a government that gets out there in the world and sells your products and services.”

And Osborne is correct. The government needs to be willing to embrace change and innovation. The regulatory regime must be part of the equation – and see themselves as a positive catalyst – not a barrier. This goes hand in hand with a tax system that does not hobble business by forcing corporations to vote with their feet, hunting elsewhere for more rational rules. Meanwhile, here, in the United States, we have been waiting for over 2 years for final rules on Title III of the JOBS Act, retail crowdfunding. We are also still waiting to see if regulators push forward on Title IV of the Act, one that includes state blue sky preemption something that lobbyists & special interest groups now battle against. For now the US yearns for a government that is willing to challenge the status quo of traditional finance – whilst the UK moves forward. Where does this lead the world’s largest economy?

The Chancellors speech is below in its entirety.

______________________________

Chancellor’s speech at the launch of the new trade body for FinTech, ‘Innovate Finance’.

It is fantastic to be here today as you launch ‘Innovate Finance’.

Fantastic to be here at Level 39 – the largest Financial Technology Accelerator in Europe

I am here today because the technologies that you are developing have a huge economic potential for our country, and for the world.

Just as the introduction of paper money hundreds of years ago revolutionised commerce.

So the technologies being developed today will revolutionise the way we bank, the way we invest, the way companies raise money. It will lead to new products, new services, new lenders.

And the exciting thing about combining new technology and a free market is that no one in this room – certainly not me – can predict exactly how these new forms of banking will develop.

What we can do and I can do, is create the best environment in which this financial innovation can flourish.

I’m here today because I want the UK to lead the world in developing Fin Tech.

That’s my ambition – short and sweet.

We have all the ingredients we need:

We are the world’s leading financial capital.

We have among the best scientific research; one of the greatest tech hubs in the world, near here in Tech City; and the highest density of start-ups in the world.

We have a long history of leading the way in financial innovation – from the first insurance market and the invention of joint stock companies centuries ago, to our rapid emergence now as the Western centre for new global currencies like RMB.

And with the right backing from government, I believe we can make London the Fin Tech capital of the world. For me this is not an add-on to what the City already does.

It has to be what the City becomes in the future.

People are using technology in new ways to communicate, to form social groups, to shop – why not new ways to bank?

And that means much much more than just viewing your statement online.

It means being able to bypass traditional banks altogether, and lend money directly – through peer-to-peer platforms like Funding Circle and Zopa, both represented here today.

It means being able to wire money around the world without paying high fees –through technologies like Transfer Wise.

It means being able to analyse how you’re spending your money, being able to transfer it directly to a friend or relative, even managing your kids’ allowance on your phone – which you can now do with services like Meniga, Pay-M, and Yoyo.

Of course it’s not just about personal banking.

Whether it’s making debit payments cheaper for our shops, or using big data to analyse investments in private companies, or opening up new ways to fund new start-ups, or developing the best cyber security technology – Fin Tech will transform the way we do business, and UK companies are already leading the way.

But we must not be complacent – or think that Britain has some innate right to lead the world.

There is fierce international competition for this growing industry. And you need the right support from government to win this global race – you need the best investment environment, the right tax system, the appropriate regulatory rules, the best infrastructure, and a government that gets out there in the world and sells your products and services.

And I’m here today to announce new measures to back you in all these areas.

First, investment and tax.

We’re introducing the right tax regime for this new industry.

- With major new incentives to encourage investment in start-ups

- Patent Box, so that if you invent in the UK you only pay 10% on those profits

- and now we will allow peer-to-peer lending in ISAs

And we’re backing you with public investment too.

The British Business Bank has already committed over £100 million of new funding to Fin Tech companies and to the development of new and innovative forms of finance.

This investment programme has benefited many companies represented here, and many other small, innovative businesses.

But I want it to go much further. So today I can announce I am extending the scheme with another £100 million.

That’s a huge new investment in companies like yours – which will have benefits for businesses in all sectors of our economy.

Today’s commitment is part of a massive programme of investment in science and research which I have made a personal priority of mine in Government. And to make sure that we stay ahead of the game – and we are prioritising investment to support the FinTech industry – I am today asking one of our best scientists, the Government’s chief scientific advisor, Sir Mark Walport, to lead a review into the future of FinTech and what more we can do to back you.

That’s investment.

Second, we’re backing you by creating a regulatory environment that gives new entrants the chance to succeed.

We’ve already introduced legislation so FinTech companies can get access to credit data on small businesses, can access Payments Systems, and can compete more effectively in business lending. Today I can announce that as part of the first ever Small Business Bill going through parliament, this government will legislate to require the big UK banks to pass on information on small businesses they reject for loans, so that FinTech Companies and alternative lenders can step in and offer finance instead.

So often a small business will be suitable for finance, but 70% only approach one bank and nearly 40% give up at the first attempt. Meaning many businesses just don’t get the finance they need.

No more. This legislation will bring a whole wave of new lenders much closer to the small businesses they serve.

And I am pleased to announce a new partnership between Innovate Finance and the British Business Bank to champion FinTech and the opportunities it creates for small businesses to access the finance they need.

Regulation has to be pro-innovation.

So we’re also passing laws to unlock new technologies – like letting people use their smart phones to pay in cheques.

And the FCA has committed to open its doors to financial service firms who are developing new approaches, to help them navigate the regulatory system and identify areas where the regulatory system needs to adapt to new technology.

These are positive developments that I hope will help us create the right, pro-innovation regulatory environment

And recognising that the world of finance as we know it is changing in front of our eyes, I can today announce that the Government will start a major programme of work exploring the potential of virtual currencies and digital money.

These alternative payment systems are popular because they are quick, cheap, and convenient – and I want to see whether we can make more use of them for the benefit of the UK economy and British consumers. I also want to be alert to the risks that accompany any new technology.

So I’m kicking off this programme of work today.

Among other things it will look into whether regulation of the sector is required, so that virtual currency business can continue to set up in the UK, and for people and businesses to use them safely.

Third, we’re backing you and the whole British economy with the digital infrastructure we’re going to need if Britain is to grow and succeed in the long term.

We’re rolling out 4G and superfast broadband now.

We’ve set out a new, more flexible Spectrum Strategy which will support the Internet of Things.

Now I want us to look toward the next set of challenges.

Historically we have always been on the back foot. Governments – of all political parties – have built digital infrastructure to meet current needs – without planning ahead to provide the capacity that we’ll need in the future.

No longer.

Today I am launching a consultation on how we plan for the next wave of digital infrastructure, so we can unlock the full potential of 5G and fibre networks.

Whether it’s:

- being fully connected at all times

- phones that don’t lose signal and download at up to 1 Gb per second

- immersive home networks where all your devices are interconnected

We’re consulting today so we can make sure we build the digital infrastructure we need to support it.

The best investment environment. The best regulatory environment. The best infrastructure.

The final thing we need, for the UK to be the global FinTech capital, is a government that gets out there in the world – that uses our extensive network of embassies and trade delegations – to sell what you do.

So I have asked UK Trade & Investment to make this a priority.

And today we are launching their campaign to make the UK the destination of choice for setting up a FinTech company. And to encourage companies around the world to come here as the springboard for internationalising their FinTech business.

My message today is simple:

We stand at the dawn of a new era in banking.

Mobile banking apps, peer to peer lending, virtual currencies – technologies such as these are going to transform our lives, and create huge economic opportunities.

Today I’m taking major new steps to make sure the UK leads the world in developing these exciting technologies

- new investment.

- support for innovation.

- international campaign to sell British technology.

- seizing the potential of 5G.

That’s how we’re going to make the UK the FinTech capital of the world – as part of our long term economic plan to cement Britain’s position as the centre of global finance and global technology.

We’re giving you the backing you need to thrive.

Now let’s get on with it.

Thank you.