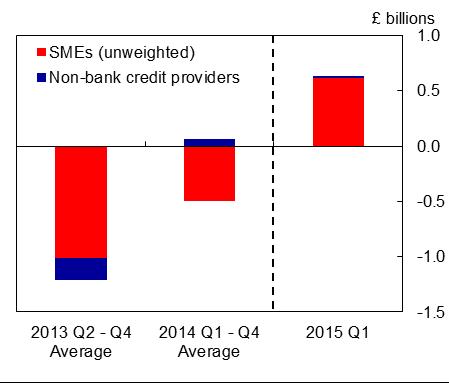

The Bank of England has published the quarterly update on the Funding for Lending Scheme (FLS) for Q1 of 2015. According to the report, net lending by FLS Extension participants to SMEs was £0.6bn in the first quarter of 2015. This compares with quarterly net lending to SMEs in 2014 Q4 by FLS participants of -£0.8bn, while the quarterly average for 2014 was -£0.5bn (Chart 1).2 A number of institutions expanded their lending in 2015 Q1 and further borrowing allowances of £4.9bn have been generated, spread across 16 participants.

Aggregate net lending to SMEs (i.e. including lending by banks and building societies not participating in the FLS) was also positive in 2015 Q1. This is part of a broader improvement in lending to all non-financial businesses.

The Bank of England states that credit conditions have improved for SMEs. This has continued in 2015. According to the FSB Voice of Small Business Index, availability of credit to small businesses has risen in 2015 Q1. And in the Bank’s 2015 Q1 Credit Conditions Survey (CCS), lenders reported that spreads over reference rates for medium-sized companies fell significantly over the quarter. The CCS also reported that spreads were broadly unchanged for smaller companies however, while the Bank’s network of Agents report that some small companies continued to find it difficult to borrow from banks.4

The improvement in corporate credit conditions in part reflects the significant fall in bank funding costs that has occurred since the launch of the FLS. Over the first quarter of 2015, the level of funding costs remained low. The FLS Extension will continue to support lending to SMEs in 2015.

Also published was the SME Finance Monitor covering Q1 data that was described as positive as more SMEs are making a profit and fewer injecting personal funds to finance the business.

Louise Beaumont, Head of Public Affairs and Marketing at GLI Finance, commented on the SME report and small business in general providing a perspective from alternative finance;

“Whilst the growing awareness of crowdfunding amongst SMEs is welcomed, it’s clear that more must be done to educate these businesses about their funding options – including the full range of alternative finance products. Crucially it’s not just a volume issue, it’s about high-growth businesses being able to access credit solutions that actually meet their needs effectively and efficiently.

“It’s for this reason that the government must invest in high impact national campaigns that educate and inform small businesses – which are the lifeblood of the UK economy – about the financing options available to them. It is a tragedy nearly a half of first time borrowers have the door slammed in their faces by traditional lenders and we must ensure that through better awareness and a well implemented referral system they are not left in the wilderness but can instead be offered a whole market view of the solutions available to them.”