Islamic Crowdfunding has the potential to help us change our world for the better. When an online community unites and pools resources, this community has the financial and social clout and capability to create and re-create multiple aspects of the world and directly impact society.

Islamic Crowdfunding has the potential to help us change our world for the better. When an online community unites and pools resources, this community has the financial and social clout and capability to create and re-create multiple aspects of the world and directly impact society.

Crowdfunding itself started and blossomed in the West initially amongst groups of like-minded individuals wanting to create something. In its infant years, crowdfunding was a fundraising tool for supporters of musical or arts projects, until Kickstarter and Indiegogo, two pioneering platforms, went viral and kicked off this global revolution. Last year, these two platforms Crowdfunded a total of more than US $1 billion! A recent report by Massolution projects this fast-growing industry to hit a whopping US $35 billion globally in 2015.

There is an immense variety and scope of applications for crowdfunding. Crowdfunding continues to evolve and in recent years made strides into the investment world. Real Estate Crowdfunding is one of the fastest-growing segments of this booming industry worldwide. The Global Crowdfunding industry is still dominated by the US, but Asia has recently seen strong growth – eclipsing Europe as the next-largest Crowdfunding region.

There is an immense variety and scope of applications for crowdfunding. Crowdfunding continues to evolve and in recent years made strides into the investment world. Real Estate Crowdfunding is one of the fastest-growing segments of this booming industry worldwide. The Global Crowdfunding industry is still dominated by the US, but Asia has recently seen strong growth – eclipsing Europe as the next-largest Crowdfunding region.

Crowdfunding platforms are able to grow rapidly because of technology. The ease & speed of online transactions, as well as the ability to fund projects directly makes Crowdfunding highly appealing, especially to Millenials. Investment-based Crowdfunding has also benefited from the decline in sentiment towards the Financial World. The recent financial crises, continued insipid returns, and stock-market volatility have cast a dreary gloom over the Financial World. The top-heavy nature of our Financial Systems, and its perceived role in the creation of inequality has also diminished its popularity. There are now even groups and movements campaigning against the perceived ‘Financialization’ of the global economy.

Savvy and progressive investors are thus turning enthusiastically to Crowdfunding as their investment vehicle of choice. The low-entry capital makes it especially accessible to the middle income and small-medium business owners.

There are three main objects of investments through crowdfunding:

- Crowdfunding of Startups empowers entrepreneurs but has an inherently higher risk of failure. This creative power is however hugely appealing, and we all dream of having a share in the next big thing (called a Unicorn in tech-speak). There is also a rising trend where a startup’s Crowdfunding success is taken as proof-of-concept and thus attracts further rounds of Angel or Venture Capital.

- SME Crowdfunding helps to bridge funding gaps, exacerbated by the credit crunch, for stable and growing companies to expand.

- Real Estate Crowdfunding breaks down the capital-barrier to this favourite investment of the wealthy. At this continues to gain traction, it will help reduce the yawning income-inequality created by the disparity in the ownership of land and real estate assets.

There are four common types of crowdfunding today – debt investment, equity investment, rewards and donations. Debt investment is based on fixed-interest returns with capital guaranteed. Equity investment is where investors and business owners have shared ownership – this is in line with Shariah law. This year, the Securities Commission Malaysia announced the licensing of six equity crowdfunding platforms, which is a positive sign for crowdfunding in the Muslim World. Rewards are typically for supporting startups, where the reward can range from the actual object of crowdfunding (a form of pre-ordering) to something simple like a t-shirt. Donations is purely philanthropic giving with no commercial return.

There are four common types of crowdfunding today – debt investment, equity investment, rewards and donations. Debt investment is based on fixed-interest returns with capital guaranteed. Equity investment is where investors and business owners have shared ownership – this is in line with Shariah law. This year, the Securities Commission Malaysia announced the licensing of six equity crowdfunding platforms, which is a positive sign for crowdfunding in the Muslim World. Rewards are typically for supporting startups, where the reward can range from the actual object of crowdfunding (a form of pre-ordering) to something simple like a t-shirt. Donations is purely philanthropic giving with no commercial return.

Why Islamic Crowdfunding?

Alternative investments allow individuals to not only profit, but also do something good to bring benefit to society. Crowdfunding allows the building of communities and promotes ethical and social responsibility which are critical aspects of the Islamic Worldview. Islamic Crowdfunding is an unprecedented opportunity that very rarely comes. Muslims have been trapped in a capitalist system where money and profit are the main motives of life. With this new wave, Muslims are empowered to create an ecosystem based on our own value-systems.

Islamic Finance will never be the same again, once Islamic Crowdfunding has greater outreach and acceptance. The backbone of Islamic Crowdfunding is the Community, whereas Islamic Banks emerged from a much more corporate environment. When the overriding motive and mechanism revolves around community, profit motives cease to be at the forefront of decision-making. Decisions are based on a more holistic view of community benefit, which results in many wonderful initiatives and movements for social good. Islamic Crowdfunding has the unique ability to empower the masses to create and re-create products, lifestyles and communities independent of capitalist corporations or bureaucratic governments. In essence, if harnessed properly, society is now able to shape its own world based on its own needs, wants and principles.

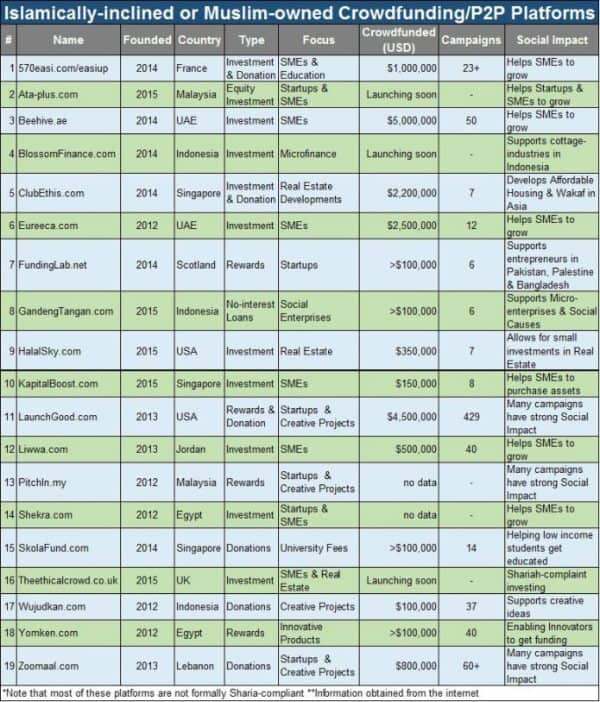

Yet Islamic Crowdfunding has taken some time to get off the ground. Until 2014, there was only a handful of Islamic Crowdfunding platforms worldwide, but over the past 2 years, many new platforms have sprung up. A prominent platform in the Middle East is Liwwa, which is Jordan/Palestinian-based and has Crowdfunded small businesses with a total of US $500,000 to date. Interestingly Liwwa is one of the few Islamic platforms backed by both Venture Capital Funds as well as Banks.

Statistics are scarce but I estimate Islamic Crowdfunding globally in 2015 to be at approximately US $25 million.

Two or the larger Platforms outside the Middle East are LaunchGood from the US & ClubEthis (Ethis = Ethical + Islamic) from Singapore. LaunchGood is focused on Kickstarter-styled reward-based Crowdfunding of new ideas or causes, and has Crowdfunded more than US4.5million to date. Club Ethis focuses on Real Estate Development Crowdfunding of Affordable Housing in Indonesia, and has Crowdfunded US2.2million since March 2015. More significantly, the projects that Crowdfunding has enabled it to start on will eventually provide more than 1,500 homes for the needy – talk about social impact!

Real estate crowdfunding is one of the most lucrative forms of investment. This sub-sector projected to Crowdfund $2.5 billion this year. This form of crowdfunding may be more complex, as Real Estate regulations and markets differ greatly between territories.

Conclusion

Crowdfunding is a natural way forward for Muslims and Muslim countries. Muslims make up almost a quarter of the world, and we have a young and fast-growing population. Even the World Bank predicts that the Muslim world may be one of the first markets in which crowdfunding investment would be truly game-changing. As Islamic Crowdfunding matures and grows from strength to strength, it is up to Muslims to participate in the creation of a truly Islamic ecosystem that has the capacity to bring tremendous benefits to our lives, and to humanity as a whole.

Umar Munshi is a co-founder of Club Ethis, the world’s first Shari’ah-Compliant Real Estate platform & Kapital Boost an SME Crowdfunding site. He is also a partner at Amanah Asset Management, a firm specialising in Islamic Finance Consultancy and Events. Mr Munshi has been immersed in Islamic Finance for three years, focused on creating market awareness and reaching out to the larger community. Mr Munshi has been an entrepreneur since the age of 18, and has developed startups in F&B, Healthcare, Technology and Education in Singapore, Indonesia, Malaysia and Saudi Arabia. At the age of 23, he was recognised as a nominee for the Young Entrepreneur of the Year Award by the Singapore Malay Chamber of Commerce. His strength is in developing marketing concepts and innovations in new and emerging market niches.

Umar Munshi is a co-founder of Club Ethis, the world’s first Shari’ah-Compliant Real Estate platform & Kapital Boost an SME Crowdfunding site. He is also a partner at Amanah Asset Management, a firm specialising in Islamic Finance Consultancy and Events. Mr Munshi has been immersed in Islamic Finance for three years, focused on creating market awareness and reaching out to the larger community. Mr Munshi has been an entrepreneur since the age of 18, and has developed startups in F&B, Healthcare, Technology and Education in Singapore, Indonesia, Malaysia and Saudi Arabia. At the age of 23, he was recognised as a nominee for the Young Entrepreneur of the Year Award by the Singapore Malay Chamber of Commerce. His strength is in developing marketing concepts and innovations in new and emerging market niches.