Exploring the dynamics of equity crowdfunding and provoking thought about what crowdfunding means to you.

Crowdfunding has always existed, and will continue to exist, as long as there are people and scarcity of resources. People have pooled and transferred resources for the benefit of another, or investment in something greater, as long as history can be recounted. The concept is as old, or older, than the bible, and is manifesting in ways never before imagined.

Today, we see crowdfunding in equity and rewards contexts, meaning that people are collectively investing with the expectation of a return, or charitably contributing for a non-monetary benefit, both on the internet and in other environments. Online we observe peer-to-peer (marketplace) lending sites like LendingClub and rewards platforms like Kickstarter, and hundreds of other examples, launching to promote small business growth and personal agendas. Non-internet based methods exist globally too such as in the form of savings circles.

Today, we see crowdfunding in equity and rewards contexts, meaning that people are collectively investing with the expectation of a return, or charitably contributing for a non-monetary benefit, both on the internet and in other environments. Online we observe peer-to-peer (marketplace) lending sites like LendingClub and rewards platforms like Kickstarter, and hundreds of other examples, launching to promote small business growth and personal agendas. Non-internet based methods exist globally too such as in the form of savings circles.

Despite its eternal presence in the marketplace, the term “equity crowdfunding” draws blank stares when introduced in modern conversation. What makes “equity crowdfunding” a mystery to the masses?

The answer is that what is “crowdfunding” is not black and white. Crowdfunding is not uniform in its expression. The internet forever changed people’s ability to connect and collaborate. And law continues to shape the opportunities and obstacles for crowdfunding participants.

A diversity of topics work together to define “crowdfunding”. The status quo shifted in the 80’s and 90’s with the birth of the internet, and the introduction of Regulation D private placements to the market. Congressional discussions of the JOBS Act sparked innovation where the internet and financial worlds intersect. Pre-JOBS Act platforms rose out of the darkness and brought fresh air to archaic investment practices. The introduction of the JOBS Act into law continues to further define “crowdfunding” in unprecedented ways.

Is Internet Financing Synonymous with Crowdfunding?

Businesses have been fundraising online since the inception of the internet. AngelList and FundersClub are heralded as the archetypes for internet financing platforms. As an early entrant in 2010, AngelList helped create a framework for internet financing platforms that did not seek to operate as, or affiliates of, broker-dealers. FundersClub, Inc., which launched in 2012, similarly brought equity investments online and allows accredited investors to invest in early stage startups seeking financing. Both platforms were granted no action relief from the SEC allowing them to avoid registration as broker-dealers under the Securities Exchange Act of 1934 despite that they were to receive compensation in the form of carried interest.

Businesses have been fundraising online since the inception of the internet. AngelList and FundersClub are heralded as the archetypes for internet financing platforms. As an early entrant in 2010, AngelList helped create a framework for internet financing platforms that did not seek to operate as, or affiliates of, broker-dealers. FundersClub, Inc., which launched in 2012, similarly brought equity investments online and allows accredited investors to invest in early stage startups seeking financing. Both platforms were granted no action relief from the SEC allowing them to avoid registration as broker-dealers under the Securities Exchange Act of 1934 despite that they were to receive compensation in the form of carried interest.

What is often ignored is that the AngelList and FundersClub methods of internet financing were in motion before the JOBS Act came into effect. Both are widely referred to as crowdfunding platforms, but are they “crowdfunding”?

The JOBS Act: Changes to Reg D

The JOBS Act was enacted by President Barack Obama on April 5, 2012. The goal of the JOBS Act was to spark capital formation by easing regulatory burdens affecting small and micro-cap businesses. The JOBS Act required the SEC to write and adopt rules to implement the various requirements of the Act. In 2013, the SEC adopted rules amending existing exemptions from registration under the Securities Act of 1933 (the “Securities Act”) and creating new exemptions to be utilized by issuers. The rule proposal to amend Regulation D, Rule 506, was approved on July 10, 2013, and became effective on September 23rd of that same year.

The JOBS Act was enacted by President Barack Obama on April 5, 2012. The goal of the JOBS Act was to spark capital formation by easing regulatory burdens affecting small and micro-cap businesses. The JOBS Act required the SEC to write and adopt rules to implement the various requirements of the Act. In 2013, the SEC adopted rules amending existing exemptions from registration under the Securities Act of 1933 (the “Securities Act”) and creating new exemptions to be utilized by issuers. The rule proposal to amend Regulation D, Rule 506, was approved on July 10, 2013, and became effective on September 23rd of that same year.

The old Rule 506

Regulation D, Rule 506(b) remains unchanged since its promulgation by the SEC in 1982. It continues to be available to issuers not wishing to generally solicit their offerings. Under this safe harbor, an unlimited amount of securities may be sold to accredited investors, and up to 35 non-accredited investors, provided that the issuer believes the investor has “such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the prospective investment, or . . . immediately prior to making any sale that such purchaser comes within this description.” 17 C.F.R. § 230.506 section (2)(ii).

Regulation D, Rule 506(b) remains unchanged since its promulgation by the SEC in 1982. It continues to be available to issuers not wishing to generally solicit their offerings. Under this safe harbor, an unlimited amount of securities may be sold to accredited investors, and up to 35 non-accredited investors, provided that the issuer believes the investor has “such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the prospective investment, or . . . immediately prior to making any sale that such purchaser comes within this description.” 17 C.F.R. § 230.506 section (2)(ii).

Rule 506(c) of Reg D

In the July 10th meeting, the SEC amended Rule 506 and adopted paragraph (c) to permit general solicitation, as required under Section 201(a) of the JOBS Act, where all purchasers of the securities are accredited investors and the issuer takes “reasonable steps” to verify that the purchasers are accredited investors.

In the July 10th meeting, the SEC amended Rule 506 and adopted paragraph (c) to permit general solicitation, as required under Section 201(a) of the JOBS Act, where all purchasers of the securities are accredited investors and the issuer takes “reasonable steps” to verify that the purchasers are accredited investors.

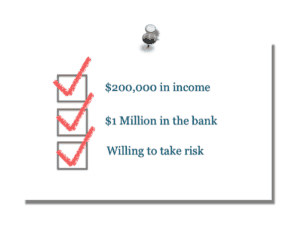

While other categories exist within the definition, an “accredited investor” includes a natural person who:

- earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, or

- has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

The issuer has the burden of taking “reasonable steps” to verify investors’ accreditation status. In the Adopting Release, the SEC established a principles-based approach and four non-exclusive methods to confirm accreditation status.

Does “Crowdfunding” Imply Solicitation???

There are now dozens, soon to be hundreds, of real estate investment platforms in the USA. A handful of these sites are recognized as the pioneers of real estate crowdfunding. Yet, many of these early entrants rely on the Reg D, Rule 506(b) safe harbor. While they go on to hold themselves out as “crowdfunding platforms” and use the lingo in their tag lines and conference swag, the reality is that they are not generally soliciting investment opportunities from the crowd. As discussed above, Rule 506(b) private placements have been available long before “crowdfunding” platforms took center stage. This begs the question: Does “crowdfunding” imply solicitation?

There are now dozens, soon to be hundreds, of real estate investment platforms in the USA. A handful of these sites are recognized as the pioneers of real estate crowdfunding. Yet, many of these early entrants rely on the Reg D, Rule 506(b) safe harbor. While they go on to hold themselves out as “crowdfunding platforms” and use the lingo in their tag lines and conference swag, the reality is that they are not generally soliciting investment opportunities from the crowd. As discussed above, Rule 506(b) private placements have been available long before “crowdfunding” platforms took center stage. This begs the question: Does “crowdfunding” imply solicitation?

Surveying the Real Estate Crowdfunding Marketplace

Some of the most notable 506(b) real estate investment platforms include:

- iFunding,

- RealtyShares,

- Fundrise, and

- RealtyMogul

Rule 506(b) issuers can simply rely on investors’ attestations of their accredited investor status provided there exists a pre-existing substantive relationship between the issuer and investor, among other requirements.

Rule 506(b) issuers can simply rely on investors’ attestations of their accredited investor status provided there exists a pre-existing substantive relationship between the issuer and investor, among other requirements.

Some noteworthy platforms that have consistently chosen to generally solicit real estate investments include:

- Patch of Land, and

- Prodigy Network.

Reg D, Rule 506(c) platforms that act as serial issuers bear the brunt of meeting the “reasonable steps” standard to verify the accreditation status of participating investors.

Finally, a host of platforms that serve as connectors between accredited investors and sponsors/ borrowers include CrowdStreet and RealCrowd. These platforms may choose to provide compliance services to issuers listing on their site but are not required to do so. CrowdStreet, for example, will support the issuer in meeting its obligations but again, ultimately, it is the issuer’s responsibility.

While these efforts are taking place behind the scenes, investors should be taking the time to do their own diligence on the issuers and platforms. Understanding which model a platform is following, where investors’ funds are flowing, and who controls those funds at any point in time should be an absolute minimum, and the basic first steps in tackling their diligence checklist.

Today, internet financing sites, and issuers, have a variety of exemptions available that are intended to ease the regulatory limitations of the pre-JOBS Act era. The successfulness of the JOBS Act in its mission will be determined by whether issuers choose to leverage these opportunities by general soliciting, developing innovative offering structures under Reg A+, and eventually offering securities to unaccredited investors under Regulation Crowdfunding.

Of the real estate investing platforms discussed above, only Fundrise has utilized exemptions outside Regulation D in their eREIT offering under Reg A+, and their initial offerings under the old Reg A. None have taken a formal public position on whether they will be registering with the SEC and FINRA as “funding portals” and accepting investments under Regulation Crowdfunding later this spring.

What’s Next for Crowdfunding

On May 16, 2016, Regulation Crowdfunding will take effect. Perhaps Reg CF is crowdfunding in its purest sense. Issuers under the new crowdfunding rules will be permitted to solicit and raise funds from anyone. In turn, they will be subject to a vast set of requirements including incorporation requirements, initial and ongoing disclosure requirements, and GAAP compliant financial reporting, among others.

On May 16, 2016, Regulation Crowdfunding will take effect. Perhaps Reg CF is crowdfunding in its purest sense. Issuers under the new crowdfunding rules will be permitted to solicit and raise funds from anyone. In turn, they will be subject to a vast set of requirements including incorporation requirements, initial and ongoing disclosure requirements, and GAAP compliant financial reporting, among others.

As posited throughout this article, the answer to “what is crowdfunding” is not crystal clear. If you call it by any other name does it not succeed?

The standard for “what is crowdfunding” is completely subjective to the individual making the assessment. The response would be different if asked of a lawyer compared to an investor, an issuer, or even a regulator. Solicitation may be considered a fundamental tenet for some, the use of the internet or availability to everyone for others.

For me, crowdfunding at its core is an expression of opportunity, resulting in the exchange of information and value. It can commence anywhere. In a closed room, a central marketplace, and on the internet. The possibilities are limitless. The question: What is crowdfunding will transform as familiarity and understanding improve, limits are stripped down, abilities expanded, technology enhanced, and interconnectivity increased. The only constraints that we truly face are those that we, through law, choose to impose.

Mark Roderick, a well-known crowdfunding attorney, recently said in his introductory remarks to a panel called “Crowdfunding Law & Order” that “crowdfunding is the intersection of finance and modern social media.”

What does crowdfunding mean to you?

Robin Sosnow, Esq., MBA, is the Principal of the Law Office of Robin Sosnow, PLLC, in New York City. Her practice focuses on business law in the areas of startups and crowdfunding. She is passionate about the power of technology in law and business. She previously acted as General Counsel for the real estate crowdfunding platform iFunding, founded in 2012. Robin is licensed to practice law in Massachusetts and New York. She holds a JD/ MBA from Suffolk University and a BA in International Studies, from Arcadia University, summa cum laude. Robin is an active member of CityBar, NYCLA, and the NYSBA and various NY MeetUps. She can be reached at sosnowr@gmail.com and Twitter @RobinSosnowEsq.