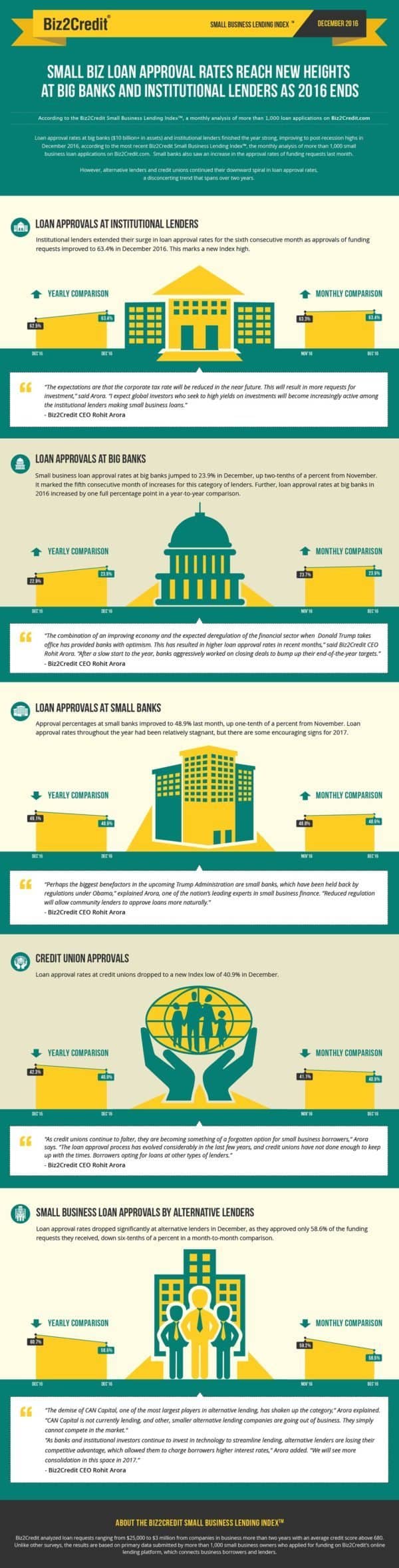

Loan approval rates at big banks ($10 billion+ in assets) and institutional lenders finished the year strong, improving to post-recession highs in December 2016, according to the most recent Biz2Credit Small Business Lending Index™, the monthly analysis of more than 1,000 small business loan applications on Biz2Credit.com. While small banks also saw an increase in the approval rates of funding requests last month, alternative lenders and credit unions continued their downward spiral in loan approval rates, a disconcerting trend that spans over two years.

Loan approval rates at big banks ($10 billion+ in assets) and institutional lenders finished the year strong, improving to post-recession highs in December 2016, according to the most recent Biz2Credit Small Business Lending Index™, the monthly analysis of more than 1,000 small business loan applications on Biz2Credit.com. While small banks also saw an increase in the approval rates of funding requests last month, alternative lenders and credit unions continued their downward spiral in loan approval rates, a disconcerting trend that spans over two years.

Small business loan approval rates at big banks jumped to 23.9% in December, up two-tenths of a percent from November, marking the fifth consecutive month of increases for this category of lenders. In addition, loan approval rates at big banks in 2016 increased by one full percentage point in a year-to-year comparison according to Biz2Credit.

“The combination of an improving economy and the expected deregulation of the financial sector when Donald Trump takes office has provided banks with optimism. This has resulted in higher loan approval rates in recent months,” analyzed Biz2Credit CEO Rohit Arora. “After a slow start to the year, banks aggressively worked on closing deals to bump up their end-of-the-year targets.”

Approval percentages at small banks improved to 48.9% last month, up one-tenth of a percent from November. Loan approval rates throughout the year had been relatively stagnant, but there are some encouraging signs for 2017.

“Perhaps the biggest benefactors in the upcoming Trump Administration are small banks, which have been held back by regulations under Obama,” added continued Arora. “Reduced regulation will allow community lenders to approve loans more naturally.”

Institutional lenders extended their surge in loan approval rates for the sixth consecutive month as approvals of funding requests improved to 63.4% in December 2016, a new Index high.

Institutional lenders extended their surge in loan approval rates for the sixth consecutive month as approvals of funding requests improved to 63.4% in December 2016, a new Index high.

“The expectations are that the corporate tax rate will be reduced in the near future. This will result in more requests for investment,” predicted Arora. “I expect global investors who seek to high yields on investments will become increasingly active among the institutional lenders making small business loans.”

Loan approval rates dropped significantly at alternative lenders in December, as they approved only 58.6% of the funding requests they received, down six-tenths of a percent in a month-to-month comparison.

“The demise of CAN Capital, one of the most largest players in alternative lending, has shaken up the category. CAN Capital is not currently lending, and other, smaller alternative lending companies are going out of business. They simply cannot compete in the market. As banks and institutional investors continue to invest in technology to streamline lending, alternative lenders are losing their competitive advantage, which allowed them to charge borrowers higher interest rates,” Arora added. “We will see more consolidation in this space in 2017.”

Loan approval rates at credit unions dropped to a new Index low of 40.9% in December.

“As credit unions continue to falter, they are becoming something of a forgotten option for small business borrowers,” Arora concluded. “The loan approval process has evolved considerably in the last few years, and credit unions have not done enough to keep up with the times. Borrowers opting for loans at other types of lenders.”

“The combination of an improving economy and the expected deregulation of the financial sector when Donald Trump takes office has provided banks with optimism. This has resulted in higher loan approval rates in recent months,” analyzed Biz2Credit CEO

“The combination of an improving economy and the expected deregulation of the financial sector when Donald Trump takes office has provided banks with optimism. This has resulted in higher loan approval rates in recent months,” analyzed Biz2Credit CEO  “The

“The