“Having trusted, independent research is critical to cutting through some of the noise from a fast-changing space like alternative finance…We cut across to give a big picture view which isn’t typically available in other research.”

It’s official, alternative finance platforms have been granted an extension to respond to 2017 Americas Alternative Finance Industry Survey. Complete it now — it will only take 20 minutes and your answers have tremendous research value. And to answer a frequently asked question, the research resulting from the survey will be free. But your responses are priceless.

This year’s study builds upon the success of the Polsky Center for Entrepreneurship and Innovation at the University of Chicago and the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School inaugural report, “Breaking New Ground,” highlighting the size, growth and key market trends of the online alternative finance market across the United States, Canada, and Latin America and the Caribbean. The report is one of a series, which includes the global benchmarking for alternative finance activity in the Asia-Pacific region, Europe, Africa, the Middle East and the United Kingdom.

This year’s study builds upon the success of the Polsky Center for Entrepreneurship and Innovation at the University of Chicago and the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School inaugural report, “Breaking New Ground,” highlighting the size, growth and key market trends of the online alternative finance market across the United States, Canada, and Latin America and the Caribbean. The report is one of a series, which includes the global benchmarking for alternative finance activity in the Asia-Pacific region, Europe, Africa, the Middle East and the United Kingdom.

Last year 257 platforms responded, with hopes of more platforms responding this year. All platforms – successful, unsuccessful, growing and failing – in the sector are encouraged to respond. English, Spanish and Portuguese versions of the survey are available.

“We recognize that this is not the easiest survey to complete, but this is a complicated industry that we want to capture well. Together we can create better research in this fast-evolving area. We’re reaching out across Canada, Latin America and the US,” commented new Polsky Center Director E. J. Reedy. “Personally I like to think of this research as community building. We’re studying a group that is experiencing a lot of change. We’re long-term partners in understanding this change, providing guideposts, benchmarks, and insights along the way. This report will capture the results of big changes in regulation and 2016 market turbulence, but also where growth is happening, where change is happening from one type of platform to another, and where might we be finding some segments of the industry deciding that there are better opportunities elsewhere.”

The data collected will be handled with confidentiality and all data will be aggregated into a final report scheduled to publish in May 2017. The aggregate report will be disseminated freely to participating platforms across government, regulators, trade associations and major media outlets to inform policy and raise public awareness of alternative finance.

As one of the principal investigators on the 2017 Americas Alternative Finance Industry Survey, Polsky Center Director and Kauffman Foundation veteran Reedy sees an academic’s role as asking consistent and critical questions, being independent but also participating in the sector:

As one of the principal investigators on the 2017 Americas Alternative Finance Industry Survey, Polsky Center Director and Kauffman Foundation veteran Reedy sees an academic’s role as asking consistent and critical questions, being independent but also participating in the sector:

“We want to ask questions that are relevant to the industry, as well as fill a hole helping to paint a broader picture for the general public and regulators. Going to big and small industry conferences helps us to listen for trends and design questions that help us test if such trends are actually happening across the broader market.”

While a Director and Program Officer at the Kauffman Foundation, the largest global philanthropy devoted to advancing entrepreneurship and innovation, Reedy initiated two new multi-million dollar initiatives to drive better data on entrepreneurship, one with the U.S. Census Bureau and the other was a decade-long initiative to collect the Kauffman Firm Survey, a survey which followed 5,000 new businesses as they evolved. Both initiatives had a heavy focus on business financing and innovation.

Survey design, small business finance, and entrepreneurship, Alternative Finance growth and change were some of the topics Reedy covered in our Skype interview. Our interview follows:

Erin: How did you become involved with CCAF and their annual research? How has your experience researching entrepreneurship and small businesses at Kauffman helped?

E.J.: The Cambridge Center for Alternative Finance and the Polsky Center for Entrepreneurship at the University of Chicago began working to collect the Alternative Finance Industry Survey for the first time last year. I took over the work this year on behalf of the Polsky team, working with a team of researchers to collect information across the Americas.

My ten years of experience overseeing research at the Kauffman Foundation has been incredibly useful to our current work. Kauffman is one of the largest funders of research on entrepreneurship in the United States, so I’ve overseen hundreds of grants in the last decade dealing with finance, along with my own research. Bringing that experience to this already great effort has helped us to expand our survey with some new ideas but also to learn from some past efforts in very different research areas.

Erin: Please discuss this year’s survey design and how it differs from 2016. Will the approach be the same or will you be targeting different information?

E.J.: This year’s survey continues the best of last year’s work by providing a benchmark on the size and make-up of a diverse alternative finance ecosystem in the Americas. In the first report, we began to tease out key characteristics that highlighted unique features of this industry vis a vis the region. This year, the survey hones in on these findings to focus on how key stakeholders utilize altfin platforms to access funding or deploy capital. A number of our optional questions examine average deal size, default rates, repeat funding, and much more. Only a handful of questions are required for internationally comparable analysis, but we hope platform partners will answer as much as they are capable. The questionnaire can be explored here.

Erin: Which questions would you and your team like to ask the alternative finance community but couldn’t?

E.J.: The Cambridge and Polsky team is beginning a new survey in Mexico and Chile, which focuses on the fundraisers using alternative finance platforms. That will be a great way of looking even deeper inside what is going on with alternative finance, as we’ll for the first time start to understand why people are coming to the platforms and some of their pre-platform experience. That’s a complementary initiative to our current survey but is an example of what we can’t get from a survey of platforms.

Erin: How does gender play a role in altfin?

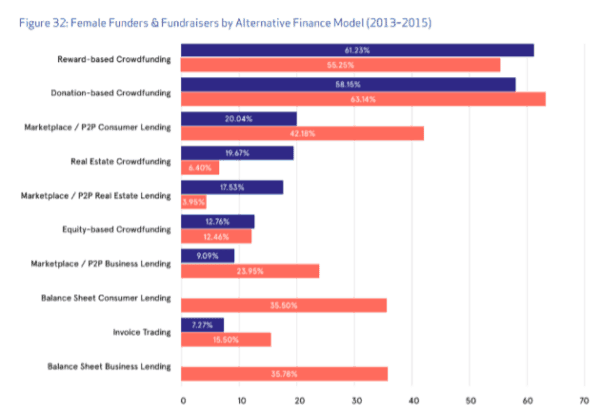

E.J.: Gender plays a role in lots of different ways in who seeks financing and how it is provided. Last year’s research showed really interesting patterns across the many types of platforms we reach, with high levels of female funders and fundraisers in reward and donation-based crowdfunding.

Erin: What are your predictions for this current report? What innovations and developments have you noted globally? What new trends are establishing and where? Which countries are leading the charge in this part of the world? Why?

E.J.: The United States continues to be a global leader in the provision of alternative finance and the iteration of different types of platforms. While it’s early to draw out conclusions from current year research, I definitely see a few things. First, there is a lot of growth among some of the bigger players within the industry with additional capital flowing in and new types of partnerships. Second, I see many platforms that are iterating on their models by offering new and complimentary finance products, moving from one type of model to another or included an active secondary market to facilitate liquidity. Third, I see some consolidation and dropping out of smaller platforms, although not necessarily at the levels many predicted.

Erin: Have you noticed a change in perception from policy makers and regulators? How can the CCAF study help?

E.J.: The 2017 Americas Alternative Finance Industry Survey and its partner surveys globally are absolutely critical for policy makers and regulators. Having trusted, independent research is critical to cutting through some of the noise from a fast-changing space like alternative finance. We know that regulators are a huge user of our reports, as is industry and the general public. We try to capture the universe and show more than just crowdfunding or marketplace lending. We cut across to give a big picture view which isn’t typically available in other research.

Erin: What in your opinion are the key issues facing the alternative finance sector? Where are the potential fissures and how can these weaknesses be strengthened?

E.J.: The alternative finance industry is growing and coming of age. It is no longer off the radar, which creates lots of opportunities but also some challenges. Opportunity has come and I suspect will continue to come in reaching bigger audiences through new types of partnerships, often with bigger existing financial institutions. Challenges will come in continuing to work and tweak different models to understand where demand is. That process can be messy and not everyone will survive.

Erin: How will US alternative finance be affected by the current administration?

E.J.: It’s only been a few months so it’s hard to say, but there are lots of continuing regulatory discussions which will impact how some of the new and expanding segments of the market, such as those providing broader-types of equity opportunities for business investments.

Erin: Please discuss mentoring future fintech mavens and mavericks. Are you on any boards or serving as an advisor?

E.J.: Part of the work I love at the Polsky Center is that I get to work both on industry research with this project but also mentoring new FinTech startups coming up through the university. We see lots of interest from students (particularly at Chicago Booth School of Business) in FinTech and so have focused on developing new programs to support and grow these startups. Currently we have three teams going through our world-renowned New Venture Challenge, an accelerator program that happens each spring and has resulted in nearly $5 billion in current market capitalization and outside equity investments.

To participate in the Survey please use the links below.

- English (http://bit.ly/AltFin17)

- Spanish (http://bit.ly/AltFin17Spanish)

- Portuguese (http://bit.ly/AltFin17Portuguese)

All crowdfunding, marketplace/peer-to-peer lending and other alternative finance platforms that are currently operating in North, Central and South America may take the benchmarking survey. All participating platforms wishing to be acknowledged in the benchmarking report can submit their logo for display in the 2017 Americas Alternative Finance Industry Report.

For benchmarking research enquiries please contact:

E.J. Reedy, Director of Research and International Engagement, Polsky Center for Entrepreneurship and Innovation, University of Chicago via email ereedy0@chicagobooth.edu

or

Tania Ziegler, Cambridge Centre for Alternative Finance, the University of Cambridge via email tz285@cam.ac.uk

The findings of the survey will be made publicly available in a 2017 Americas Alternative Finance Industry Report due to be published in late May 2017. This year’s survey will highlight the changing nature of alternative finance marketplace across the Americas and hopefully facilitate dialogue and learning between key stakeholders and government officials.

“We recognize that this is not the easiest survey to complete, but this is a complicated industry that we want to capture well. Together we can create better research in this fast-evolving area. We’re reaching out across Canada, Latin America and the US,” commented new Polsky Center Director

“We recognize that this is not the easiest survey to complete, but this is a complicated industry that we want to capture well. Together we can create better research in this fast-evolving area. We’re reaching out across Canada, Latin America and the US,” commented new Polsky Center Director  E.J.:

E.J.:  E.J.: This year’s survey continues the best of last year’s work by providing a benchmark on the size and make-up of a diverse alternative finance ecosystem in the Americas. In the first report, we began to tease out key characteristics that highlighted unique features of this industry vis a vis the region. This year, the survey hones in on these findings to focus on how key stakeholders utilize altfin platforms to access funding or deploy capital. A number of our optional questions examine average deal size, default rates, repeat funding, and much more. Only a handful of questions are required for internationally comparable analysis, but we hope platform partners will answer as much as they are capable. The questionnaire can be explored

E.J.: This year’s survey continues the best of last year’s work by providing a benchmark on the size and make-up of a diverse alternative finance ecosystem in the Americas. In the first report, we began to tease out key characteristics that highlighted unique features of this industry vis a vis the region. This year, the survey hones in on these findings to focus on how key stakeholders utilize altfin platforms to access funding or deploy capital. A number of our optional questions examine average deal size, default rates, repeat funding, and much more. Only a handful of questions are required for internationally comparable analysis, but we hope platform partners will answer as much as they are capable. The questionnaire can be explored

E.J.: The United States continues to be a global leader in the provision of alternative finance and the iteration of different types of platforms. While it’s early to draw out conclusions from current year research, I definitely see a few things. First, there is a lot of growth among some of the bigger players within the industry with additional capital flowing in and new types of partnerships. Second, I see many platforms that are iterating on their models by offering new and complimentary finance products, moving from one type of model to another or included an active secondary market to facilitate liquidity. Third, I see some consolidation and dropping out of smaller platforms, although not necessarily at the levels many predicted.

E.J.: The United States continues to be a global leader in the provision of alternative finance and the iteration of different types of platforms. While it’s early to draw out conclusions from current year research, I definitely see a few things. First, there is a lot of growth among some of the bigger players within the industry with additional capital flowing in and new types of partnerships. Second, I see many platforms that are iterating on their models by offering new and complimentary finance products, moving from one type of model to another or included an active secondary market to facilitate liquidity. Third, I see some consolidation and dropping out of smaller platforms, although not necessarily at the levels many predicted. E.J.: The alternative finance industry is growing and coming of age. It is no longer off the radar, which creates lots of opportunities but also some challenges. Opportunity has come and I suspect will continue to come in reaching bigger audiences through new types of partnerships, often with bigger existing financial institutions. Challenges will come in continuing to work and tweak different models to understand where demand is. That process can be messy and not everyone will survive.

E.J.: The alternative finance industry is growing and coming of age. It is no longer off the radar, which creates lots of opportunities but also some challenges. Opportunity has come and I suspect will continue to come in reaching bigger audiences through new types of partnerships, often with bigger existing financial institutions. Challenges will come in continuing to work and tweak different models to understand where demand is. That process can be messy and not everyone will survive. E.J.: Part of the work I love at the Polsky Center is that I get to work both on industry research with this project but also mentoring new FinTech startups coming up through the university. We see lots of interest from students (particularly at Chicago Booth School of Business) in FinTech and so have focused on developing new programs to support and grow these startups. Currently we have three teams going through our world-renowned

E.J.: Part of the work I love at the Polsky Center is that I get to work both on industry research with this project but also mentoring new FinTech startups coming up through the university. We see lots of interest from students (particularly at Chicago Booth School of Business) in FinTech and so have focused on developing new programs to support and grow these startups. Currently we have three teams going through our world-renowned