Deloitte has published a report on emerging Fintech Hubs around the world that analyses 44 different cities. Entitled “Connecting Global FinTech: Interim Hub Review 2017,” the document was released at the opening of the Innovate Finance Global Summit taking place in London this week. The report is an update of a similar document published in 2016 and comes following research conducted by Innovate Finance and SWIFT Innotribe. Innovate Finance recently launched the Global FinTech Hubs Federation as it seeks to build closer ties with hubs around the world through collaboration and knowledge sharing.

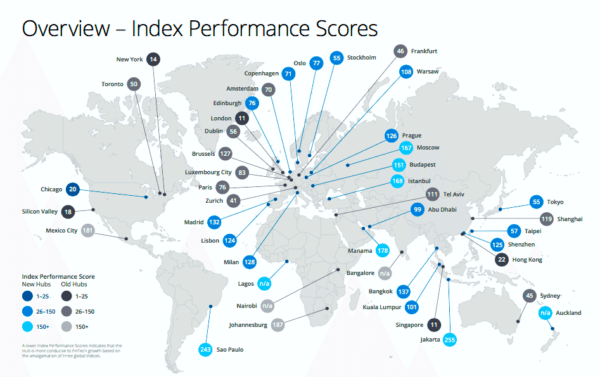

The report updates 20 of the hubs profiled in September 2016 and introduces an additional 24 hubs. Hub representatives were asked to provide a broad overview and self-assessment of their hub based on six categories including an index performance score that determines the ease of launching a Fintech business in the hub.

As one may expect, London and Singapore remain the top hubs to establish and grow a Fintech startup, based on their index performance scores. The UK was the first hub to establish itself as a center for financial innovation but Singapore has rapidly built a reputation for embracing disruptive finance as the government has publicly announced the importance of Fintech to its economy.

As one may expect, London and Singapore remain the top hubs to establish and grow a Fintech startup, based on their index performance scores. The UK was the first hub to establish itself as a center for financial innovation but Singapore has rapidly built a reputation for embracing disruptive finance as the government has publicly announced the importance of Fintech to its economy.

Fabian Vandenreydt, Global Head of Securities Markets, Innotribe and The SWIFT Institute, commented on the report;

“As the Fintech sector continues to mature globally, collaboration between the banking and startup communities has never been so important. Being one of the premier global innovation platforms, SWIFT Innotribe looks forward to strengthening connections between the 44 hubs who already joined the Federation, encouraging the sharing of best practices and leveraging their resources, networks, talent and strong expertise for the benefit of the entire financial industry.”

Speaking on behalf of the City of London, Policy Chairman Mark Boleat added;

Speaking on behalf of the City of London, Policy Chairman Mark Boleat added;

“The UK has long been a leader when it comes to Fintech and so it’s great to see our position is unchanged. It does, however, highlight the prominence of other cities vying for a slice of the pie. With competition rising, it’s important for the UK to continue championing innovation whilst maintaining the right degree of regulation to see our Fintechs thrive.We are committed to strengthening Fintech in the UK and are hopeful we can continue to lead in this sector.”

Lawrence Wintermeyer the CEO of Innovate Finance said they have been overwhelmed by the response of the global Fintech community.

“The report illustrates that Fintech is growing in size and influence globally and that ecosystems, which are rich in Fintech talent, regulatory support and investment opportunities, continues to lead the way.”

Within the report, Singapore is described as a “serious contender for the global number one spot in Fintech”. Government support for Fintech is strong with S$225 million committed to the development of Fintech projects and proofs of concept. London is said to have the “Fin” of New York and the “Tech” of the West Coast in the US. The Index Score of top-ranked Singapore and London were both pegged at 11. During a presentation by Boleat, he announced a new Fintech cluster to be established in Broadgate with the assistance of Innovate Finance.

Within the report, Singapore is described as a “serious contender for the global number one spot in Fintech”. Government support for Fintech is strong with S$225 million committed to the development of Fintech projects and proofs of concept. London is said to have the “Fin” of New York and the “Tech” of the West Coast in the US. The Index Score of top-ranked Singapore and London were both pegged at 11. During a presentation by Boleat, he announced a new Fintech cluster to be established in Broadgate with the assistance of Innovate Finance.

Regarding global Fintech VC deal value in 2016, China topped the list at $7.7 billion.

A broader report will be published by Deloitte later this year at Sibos.

[scribd id=344696699 key=key-kixnAFVloGTWf1CTQaUj mode=scroll]