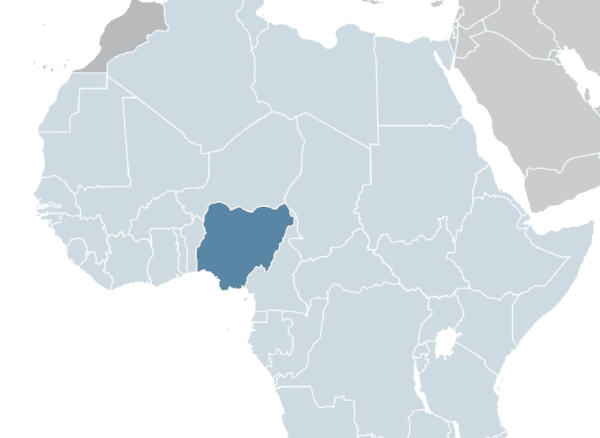

Crowdfunding is a global phenomenon but it is obviously evolving at different speeds in different countries. Africa is one region where the new form of finance can be utilized to benefit the economy. A recent report published by the CrowdfundingHub highlights a single country in Africa: Nigeria.

Researched and written by Suzanne Wisse-Huiskes of MatchBox Consultancy, the Nigeria report was created to determine the crowdfunding potential for Nigeria where a handful of platforms have emerged to provide financing services. Nigeria is an oil rich, emerging market that is a “huge market with an incredible amount of potential if one gets the formula right” for crowdfunding.

Crowdfund Insider corresponded with Wisse-Huiskes and Rondal Kleverlaan, founder of the CrowdfundingHub, a well-known research and consulting group in the alternative finance space. We asked Ronald why they published the report on Nigeria?

Crowdfund Insider corresponded with Wisse-Huiskes and Rondal Kleverlaan, founder of the CrowdfundingHub, a well-known research and consulting group in the alternative finance space. We asked Ronald why they published the report on Nigeria?

“Nigeria is one of the fastest growing emerging markets in the world and their financial infrastructure is ahead of other emerging markets with innovative mobile banking apps. Crowdfunding is developing different in emerging markets then in the current high-growth crowdfunding markets in Europe and the US,” said Kleverlaan. “As CrowdfundingHub we wanted to get an overview how crowdfunding is developing in emerging markets and we were able to collaborate with local experts in Nigeria to collect and analyse the current activities and trends.”

Regarding the potential of crowdfunding to become a catalyst for economic growth and wealth creation in Nigeria, Wisse-Huiskes explained;

“Crowdfunding can be a powerful tool for economic growth and wealth in developing countries in general. It enables entrepreneurs, artists, politicians and other individuals to tackle traditional boundaries to financing in their country to bring products and services to market in a collaborative way. It provides access to capital for a segment of the population that cannot access it through traditional means. In Nigeria, home of millions of young entrepreneurs, crowdfunding could be a great tool to kick-start organizations and individuals,” added Wisse-Huiskes.

And what are the biggest opportunities for crowdfunding in Nigeria? Wisse-Huiskes believes there are many;

And what are the biggest opportunities for crowdfunding in Nigeria? Wisse-Huiskes believes there are many;

“There are multiple opportunities for the crowdfunding industry in Nigeria. The biggest ones are firstly the strong social media usage and great network of family and friends. With a fast growing population of 179 million, where 84% has mobile connection and over half of the population is already active on Internet. Secondly, the entrepreneurial scene is expanding rapidly. Thirdly, The banking system is moving ahead of its counterparts in other emerging markets. It provides a promising infrastructure for crowdfunding in Nigeria, with innovative mobile banking apps.”

As with any market, there are challenges. Nigeria has its own specific set of hurdles, most importantly regulation, according to Wisse-Huiskes;

“Nigeria suffers from great political instability. For entrepreneurs, it ‘s difficult to anticipate whether existing policies or regulation will change. In addition, corruption and multiple taxes make it a challenging environment. In August 2016, the Securities and Exchange Commission of Nigeria (SEC) announced that equity crowdfunding is now banned in Nigeria until further notice. Donation based crowdfunding is still legal.”

Beyond shortfalls in regulation, there are major concerns regarding the lack of trust and access to credit.

“These challenges will not be easy to overcome, yet many ambitious entrepreneurs are utilizing innovative strategies to overcome these obstacles,” explained Wisse-Huiskes. “Moving forward, donation and reward based crowdfunding should be fostered as a first step towards crowdfund investing. They have successfully paved the way for equity based crowdfunding in other regions.”

The report on Nigeria and crowdfunding is embedded below.

[scribd id=345179385 key=key-FmW70hrq1ZDeWW61AGL2 mode=scroll]