This one falls under recently discovered. The Government Accountability Office (GAO) published a report on Financial Technology, or Fintech, for Congress this past April. The report, subtitled Information on Subsectors and Regulatory Oversight, was at the behest of several members of Congress including; Senator Sherrod Brown, Senator Jeffrey Merkley and Representative Jeanne Shaheen.

This one falls under recently discovered. The Government Accountability Office (GAO) published a report on Financial Technology, or Fintech, for Congress this past April. The report, subtitled Information on Subsectors and Regulatory Oversight, was at the behest of several members of Congress including; Senator Sherrod Brown, Senator Jeffrey Merkley and Representative Jeanne Shaheen.

The GAO explained;

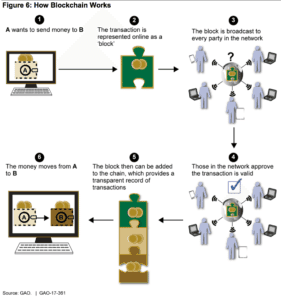

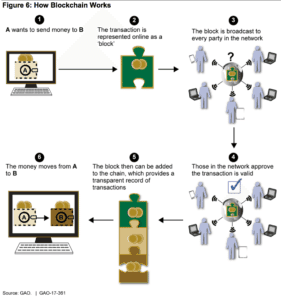

“You asked us to provide information on the fintech industry, including the marketplace lending subsector, such as its structure and development over the last several years, as well as how federal regulators supervise fintech firms. This report, the first in a series of planned reports on fintech, describes four commonly referenced subsectors of fintech: marketplace lending; mobile payments; digital wealth management; and distributed ledger technology and their regulatory oversight.”

The report is a good compendium of the aforementioned categories. The GAO publishes basic descriptions of each service along with the pros and cons. The document should be a useful, high level primer for elected officials. We look forward to future GAO reports covering Fintech.

If there is one obvious challenge highlighted by the GAO report, in a tangental manner, it is the mish-mash of regulatory agencies that have oversight over Fintech firms. Something is clearly wrong with a government that is so utterly fragmented.

The GAO lists the following regulators that hold sway over Fintech:

The GAO lists the following regulators that hold sway over Fintech:

- Board of Governors of the Federal Reserve System

- Federal Deposit Insurance Corporation (FDIC)

- National Credit Union Administration (NCUA)

- Office of the Comptroller of the Currency (OCC)

- Bureau of Consumer Financial Protection (CFPB)

- Department of Treasury Financial Crimes Enforcement Network (FinCEN)

- Federal Communications Commission (FCC)

- Federal Trade Commission (FTC)

- Securities and Exchange Commission (SEC)

- Commodity Futures Trading Commission (CFTC)

- State Banking Regulators

- State Securities Regulators

Don’t forget, there are 50 states…

Hopefully, the GAO report will help Congressional leaders recognize the regulatory burden placed upon Fintech firms, which are frequently startups, is an undue burden. The cost of this regulatory overreach is one not just born by Fintechs but is inevitably born on consumers.

[scribd id=349273655 key=key-nsGWoGzCPckwwtHQzGtv mode=scroll]