Companisto, a leading investment crowdfunding platform based in Berlin, has shared data captured by a survey of their investors. The survey, taken from 2,300 of its registered investors (out of more than 70,000) highlights some interesting information.

According to Companisto, the following information was uncovered:

- Instead of an unsophisticated smaller investors, 95% of the Crowd investors are experienced investors

- Investing in startups in technology, communications and medicine are particularly in demand

- The average investor is male (around 84%), 39 years old and his average investment is around €600 euros per company

- The total Companisto portfolio is around €2100, which is distributed on average to around 3 investments.

- The majority (57%) have a net household income of over €40,000 per year, about 30% more than €70,000 per year.

- 57% are employees and 23% are self-employed.

Co-founder and Managing Director of Companisto, Tamo Zwinge, commented on the published data;

Co-founder and Managing Director of Companisto, Tamo Zwinge, commented on the published data;

“Contrary to the often-held opinion that primarily inexperienced small investors are “seduced” into risky assets during crowdfunding an investment, the typical Companisto investor is well informed on investing and is seeking a balance between innovation and return.”

Investors are interested more in growth stage (45%) versus more mature companies (38%). The following sectors are identified as attractive: technology, IT and communication, services, medicine and health, mobility and software.

Respondents said they spread the risk in their portfolio and the majority are aware of investment in companies.

The average proportion of the total portfolios of crowdfunding in start-ups is 16%. They invest in addition to start-ups in equities (62%), equity funds (41%) and ETFs (around 33%).

The respondents also invest in less risky asset classes such as money market accounts (around 44%), savings plans (around 28%) and precious metals (around 26 %).

In addition, the transparency of investment crowdfunding is valued. Some 54% of respondents compared crowdfunding favorably to other investment opportunities.

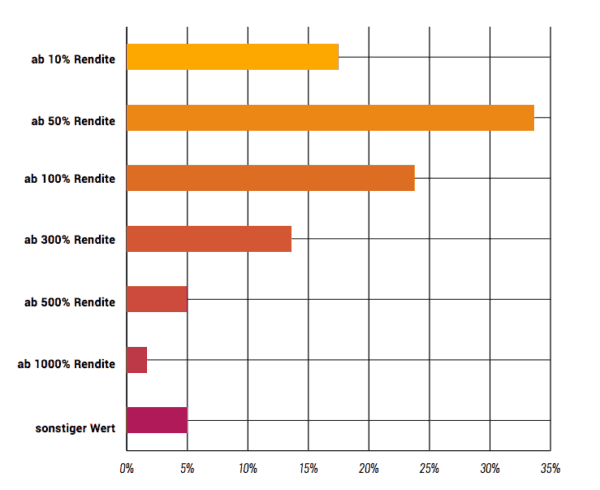

More than half of the investors are satisfied with a return of less than 100%. About a third (33.6%) promises at least 50% and only 20% expect more than 300% return.

More than half of the investors are satisfied with a return of less than 100%. About a third (33.6%) promises at least 50% and only 20% expect more than 300% return.

“This places crowds investors in the usual expectation as venture capitalists,” added David Rhotert, co-founder and Managing Director of Companisto.

Companisto services the DACH region and has raised approximately €40 million for 84 crowdfunding rounds since platform launch.

The survey, in German, is embedded below.

[scribd id=353589055 key=key-4WhbLgjzzjTxXIKf96Wr mode=scroll]